The economic effects of the coronavirus around the world

The economic effects of the coronavirus around the world

This article was updated on 14 May 2020.

Latest developments:

- 2.9 million more Americans have filed for unemployment, bringing the two-month total to more than 36 million.

- The US April unemployment rate has risen to a record 14.7%, with more than 20 million jobs lost last month.

- EU GDP is forecast to contract by 7.5% during 2020.

Confirmed cases of the COVID-19 coronavirus have topped 4 million globally. Businesses are coping with lost revenue and disrupted supply chains as factory shutdowns and quarantine measures spread across the globe, restricting movement and commerce.

Unemployment is skyrocketing, while policymakers across countries race to implement fiscal and monetary measures to alleviate the financial burden on citizens and shore up economies under severe strain.

In the US, the unemployment rate in April climbed to 14.7% – a post-war record – as more than 20 million Americans lost their jobs.

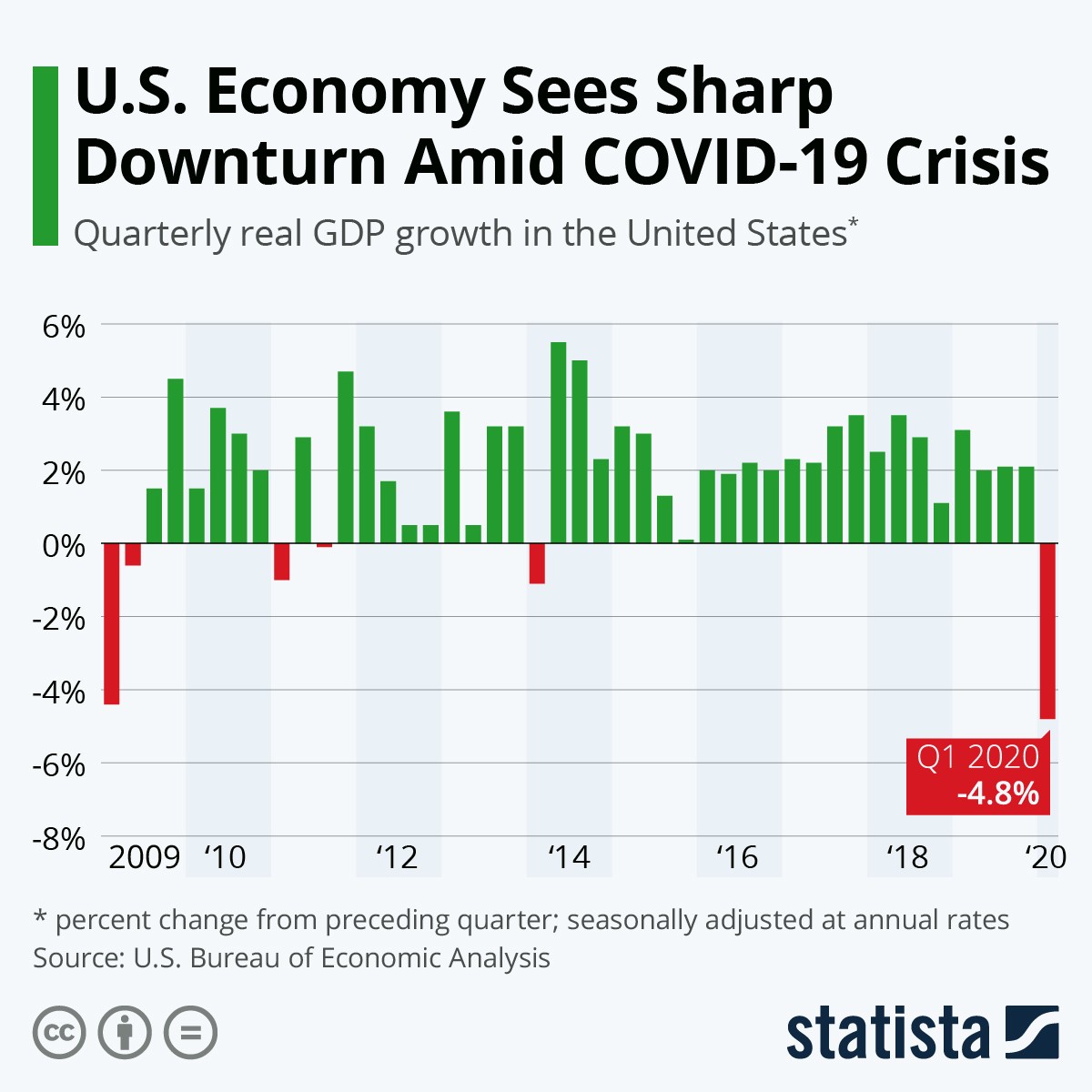

The news comes after the US Commerce Department reported a rapid decline in gross domestic product (GDP) in the first three months of the year on 29 April.

GDP dropped by 4.8% in the first quarter of 2020 – the sharpest contraction since the global financial crisis of 2007-2009 – bringing to an end the longest economic expansion in US history.

The US economy contracted for the first time since 2014 in the last quarter.

Image: Statista

The US Treasury Department has said it plans to borrow nearly $3 trillion in the second quarter of 2020 as it tries to mitigate the impacts of coronavirus. That it is five times as much as it has ever borrowed previously over a three-month period.

The International Monetary Fund (IMF) has said the coronavirus pandemic had instigated a global economic downturn the likes of which the world has not experienced since the Great Depression.

That view is supported by the latest figures from the European Commission, which has forecast that the GDP of EU countries will contract by 7.5% in 2020.

“Despite the swift and comprehensive policy response at both EU and national level, the EU economy will experience a recession of historic proportions this year,” the Commission said in its spring economic forecast released on 6 May.

Here are some of the other ways the outbreak is sending economic ripples around the world.

Predicted slump for Asia

On 15 April, the IMF warned economies in Asia would see no growth this year, for the first time in 60 years, with the service sector particularly under pressure.

National lockdowns across the region have meant airlines, factories, shops and restaurants have suffered the greatest economic shocks.

Just a day after the IMF warning, official data showed the Chinese economy had contracted in the first quarter – the first time since quarterly records began in 1992.

Gross domestic product (GDP) in the world’s second largest economy fell 6.8% in January-March year-on-year – more than the 6.5% forecast by analysts and the opposite of the 6% expansion in the fourth quarter of 2019.

The Chinese economy is likely to be hit further by reduced global demand for its products due to the effect of the outbreak on economies around the world.

Data released on 16 March showed China’s factory production plunged at the sharpest pace in three decades in the first two months of the year.

For 2020, the country’s economic growth is expected to fall to 2.5%, according to a Reuters poll – its slowest in almost 50 years.

Monetary policy: central banks act but stocks, oil continue to come under steep pressure

To combat the economic fallout, the US Federal Reserve on 15 March cut its key interest rate to near zero.

But the move, coordinated with central banks in Japan, Australia and New Zealand in a joint-effort not seen since the 2008 financial crisis, has failed to shore up global investor sentiment. As of 9 April, the S&P 500 stock index is down more than 13% since the start of the year, while global oil prices have plummeted more than 47% year-to-date.

The Fed on 9 April unveiled a new batch of programs, saying it plans to provide $2.3 billion in loans to small and midsize businesses, as well as US cities and states. The US central bank also expanded its corporate lending program to include some classes of riskier debt.

Meanwhile, the European Central Bank (ECB) also took action, launching on 18 March a €750 billion Pandemic Emergency Purchase Programme that is expected to last until the end of this year.

A fiscal response

On 20 March, the UK announced radical fiscal spending measures to counter the economic impact of a worsening crisis. The government said it would pay up to 80% of the wages of employees across the country unable to work, as most businesses shut their doors to help fight the spread of coronavirus.

Earlier in the month, the Danish government announced it would help private companies struggling to manage the fallout from the pandemic by covering 75% of employees’ salaries, if firms agreed not to cut staff.

Denmark has announced restrictions on companies that are registered in tax havens from accessing financial aid. Companies applying for state aid will also have to commit to not paying dividends or make share buy-backs this year and next.

Poland had already announced restrictions on access to state aid based on whether large firms pay taxes in the country.

The European Union more broadly has implemented fiscal measures to shore up the economy worth more than €3 trillion.

Meanwhile, the US government passed an unprecedented $2 trillion stimulus package at the end of March, including direct payouts to millions of Americans.

The impact on employment

An additional 2.9 million Americans filed for unemployment in the week ending 9 May, according to data released by the US Labor Department on 14 May, bringing the total number of jobless claims over a two-month period to more than 36 million.

![U.S. Employment and Training Administration, Initial Claims [ICSA], retrieved from FRED, Federal Reserve Bank of St. Louis](https://assets.weforum.org/editor/_QYIL1Nttit8biHrlHsCOfEE0900XpxRqY0Ve84OUCQ.png)

U.S. unemployment claims have risen to a record high.

Image: Federal Reserve Bank of St Louis

Meanwhile, India’s lockdown resulted in 122 million job losses in April alone, according to data released on 5 May by the private research agency the Centre for Monitoring the Indian Economy released on 5 May.

Of these, the vast majority (91 million) were small traders and labourers.

In the UK, the government’s independent economics forecaster, the Office for Budget Responsibility (OBR), warned on 14 April that the country’s economy could shrink by a record 35% by June 2020.

It also estimates UK unemployment could to rise by 2.1 million, to 3.4 million, by the end of June.

At the start of April, data from Spain showed nearly 900,000 people have lost their jobs since its lockdown started in mid-March. The official unemployment figure had also risen to 3.5 million – the highest level since April 2017.

Meanwhile, Bloomberg reports that around half of jobs in Africa are at risk as a result of the outbreak, according to the United Nations Economic Commission for Africa.

Impact on air travel

On 5 March – before the US travel ban was announced – the International Air Transport Association (IATA) predictied the COVID-19 outbreak could cost airlines $113 billion in lost revenue as fewer people take flights.

“The industry remains very fragile,” Brian Pearce, the IATA’s chief economist, told the Associated Press. “There are lots of airlines that have got relatively narrow profit margins and lots of debt and this could send some into a very difficult situation.”

On March 16, British Airways said it would cut flying capacity by at least 75% in April and May. Other UK airlines, including Virgin Atlantic and easyJet also announced drastic cuts.

The travel and tourism industries were hit early on by economic disruption from the outbreak.

Besides the impact on airlines, the UN’s International Civil Aviation Organization (ICAO) forecast that Japan could lose $1.29 billion of tourism revenue in the first quarter due to the drop in Chinese travellers, while Thailand could lose $1.15 billion.

Disruption to commerce

The initial shortage of products and parts from China affected companies around the world, as factories delayed opening after the Lunar New Year and workers stayed home to help reduce the spread of the virus.

What is the World Economic Forum doing about epidemics?

Epidemics are a huge threat to health and the economy: the vast spread of disease can literally destroy societies.

In 2017, at our Annual Meeting, the Coalition for Epidemic Preparedness Innovations (CEPI) was launched – bringing together experts from government, business, health, academia and civil society to accelerate the development of vaccines against emerging infectious diseases and to enable access to them during outbreaks.

Our world needs stronger, unified responses to major health threats. By creating alliances and coalitions like CEPI, which involve expertise, funding and other support, we are able to collectively address the most pressing global health challenges.

Is your organisation interested in working with the World Economic Forum to tackle global health issues? Find out more here.

Apple’s manufacturing partner in China, Foxconn, faced production delays. Some carmakers including Nissan and Hyundai temporarily closed factories outside China because they couldn’t get parts.

By March, countries such as Italy had closed all but the most essential factories.

The pharmaceutical industry, bracing for disruption to global production since February, reported fears of drug shortages as India faced lockdowns 24 March. India supplies nearly half of the generic drugs for countries such as the U.S.

Most trade shows, cultural and sporting events across the world have been cancelled or postponed.

For more World Economic Forum coverage of COVID-19, click here.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

Written by

Rosamond Hutt, Senior Writer, Formative Content

The views expressed in this article are those of the author alone and not the World Economic Forum.

A weekly update of what’s on the Global Agenda

as per our monitoring this Story originally appeared *here*

The economic effects of the coronavirus around the world

Leave a Comment