all Think Trillion Story

Think Trillion :: ‘Trillion Dollar Economy’/ ‘Trillion Dollar Company/Market/Potential’/ ‘Trillion Dollar Country’ or anything that implies the big figure ‘Trillion‘

Portray All Stories ON ‘Trillion Dollar Economy’/ ‘Trillion Dollar Company/Market’/ ‘Trillion Dollar Country’ or anything that implies the big figure ‘Trillion‘ as ‘Think Trillion Story’ here.

Add Story/ Your Say

[*Select Category/Tag: Think Trillion at Your Next Publish Screen.]

Obama’s Trillion-Dollar Nuclear-Arms Train Wreck

By Amy Goodman & Denis Moynihan

STANFORD, Calif.—“Now I am become Death, the destroyer of worlds.” These were the words from the Hindu religious text, the Bhagavad-Gita, that flashed through the mind of the man credited with creating the first atomic bomb, J. Robert Oppenheimer, as the first nuclear explosion in history lit up the dark desert sky at the Trinity blast site in New Mexico on July 16, 1945.

Weeks after that, the atomic bombing of Hiroshima, then Nagasaki, killed hundreds of thousands of civilians, and thrust the world into the atomic age. Since then, humanity has lived with the terrible prospect of nuclear war and mass annihilation. Conventional wisdom holds that the likelihood that these unconventional weapons will be used has decreased since the end of the so-called Cold War. That perception has been challenged lately, especially since President Barack Obama announced a 30-year, $1 trillion program to modernize the U.S. nuclear-weapon arsenal.

Secretary of State John Kerry visited the Hiroshima Peace Memorial Museum on Monday, the first sitting U.S. secretary of state to visit the site. Kerry was in Japan for a meeting of the G-7 nations. In his public remarks at the memorial, Kerry offered no apology for the nuclear attacks. He did say, though, that the museum “was a reminder of the depth of obligation that every single one of us in public life carries—in fact, every person in position of responsibility carries—to work for peace … to create and pursue a world free from nuclear weapons.”

Despite the lofty rhetoric, President Obama has launched what the Alliance for Nuclear Accountability calls the “Trillion Dollar Trainwreck.” That is the title of a new report on Obama’s massive plan to modernize the U.S. nuclear-weapons arsenal, to be released next Monday. Marylia Kelley is one of the report’s authors. She serves as executive director of Tri-Valley CAREs, or Communities Against a Radioactive Environment, a partner organization with the Alliance. Of Kerry’s visit to Hiroshima, Kelley said, on the “Democracy Now!” news hour, “Kerry went empty-handed. The United States needs to go with a concrete plan to roll back its own nuclear-weapons program. You cannot preach abstinence, in terms of nuclear weapons, from the biggest bar stool in the room.”

“The United States is initiating a new nuclear arms race, because the other nuclear-armed states, of course, when they look at our ‘modernization program,’ are now beginning their own,” she told us. “We need this to be rolled back.” Kelley lives in Livermore, California, home to one of the U.S. government’s national laboratories dedicated to developing and manufacturing nuclear bombs.

President Obama delivered his first address on the U.S. nuclear arsenal on April 5, 2009, in Prague: “Today, the Cold War has disappeared but thousands of those weapons have not. In a strange turn of history, the threat of global nuclear war has gone down, but the risk of a nuclear attack has gone up. More nations have acquired these weapons. Testing has continued. Black-market trade in nuclear secrets and nuclear materials abound,” he said.

As with his pledge to close the U.S. prison at Guantanamo Bay, his pledge to move the U.S. toward nuclear disarmament seems to have been abandoned. Grass-roots groups in the Alliance for Nuclear Accountability would like to see Obama make an historic trip to Hiroshima, as the first sitting U.S. president to do so. “If Obama goes to Hiroshima,” Marylia Kelley said, “he needs to use that as an opportunity, not to speak empty promises and rhetoric about an eventual world free of nuclear weapons, but to make concrete proposals about how the United States is going to take steps in that direction and how we’re going to change course, because right now we’re taking giant steps in the opposite direction.”

The U.S. nuclear arsenal, and all the expense, nuclear waste and immense danger it continuously poses, has received almost no attention in the U.S. presidential debates. The day after he launched his campaign in late May 2015, Sen. Bernie Sanders was asked about the trillion-dollar nuclear-arsenal upgrade at a town hall in New Hampshire. “What all of this is about is our national priorities,” he replied. “Who are we as a people? Does Congress listen to the military-industrial complex, who has never seen a war that they didn’t like? Or do we listen to the people of this country who are hurting?”

In 1946, the year after Trinity, after Hiroshima and Nagasaki, Albert Einstein, whose theory of relativity gave birth to the atomic bomb, offered a warning to the world that remains starkly relevant today: “The unleashed power of the atom has changed everything save our modes of thinking and we thus drift toward unparalleled catastrophe.”

as per our monitoring this Story originally appeared * : ) here → *

Obama’s Trillion-Dollar Nuclear-Arms Train Wreck

Trillion Dollar Design

Welcome to the website of Trillion Dollar Design, LLC. We hand-craft championship belts for all occasions. Contact us to order your Championship Belt today.

Dashielle Mayfield (August 26, 2006 – May 10, 2020) Non-Violent Champion Cat. We are thankful for the best 13 years ever living with you!!! RIP our lovables. Gone too soon…

Don’t be defiant, believe science. Wear your mask and life will last.

September 2020

Trillion Dollar Design, LLC Welcomes Trevor Clymens 2016 and 2018 Champion B-Modified Antioch Speedway – Bridging the Gap for Non-Violent Championship Belts June 20, 2020

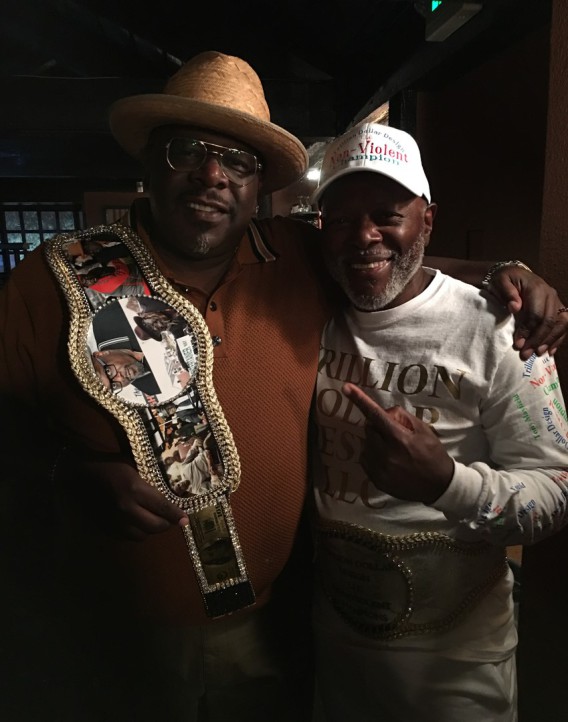

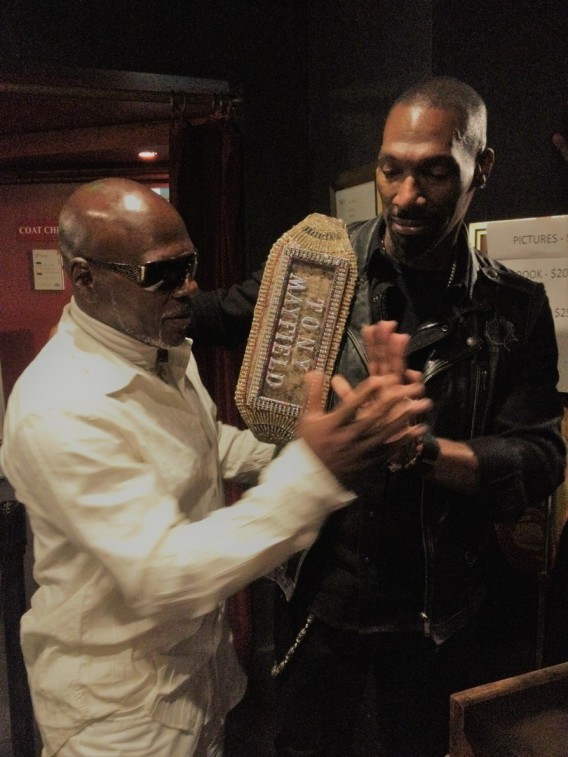

Supporters of Non-Violent Champions Tony Rock and Tony Mayfield

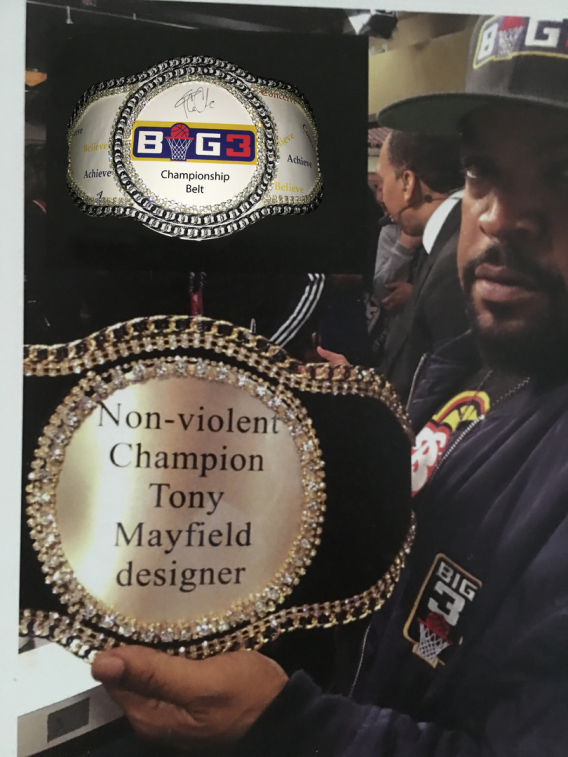

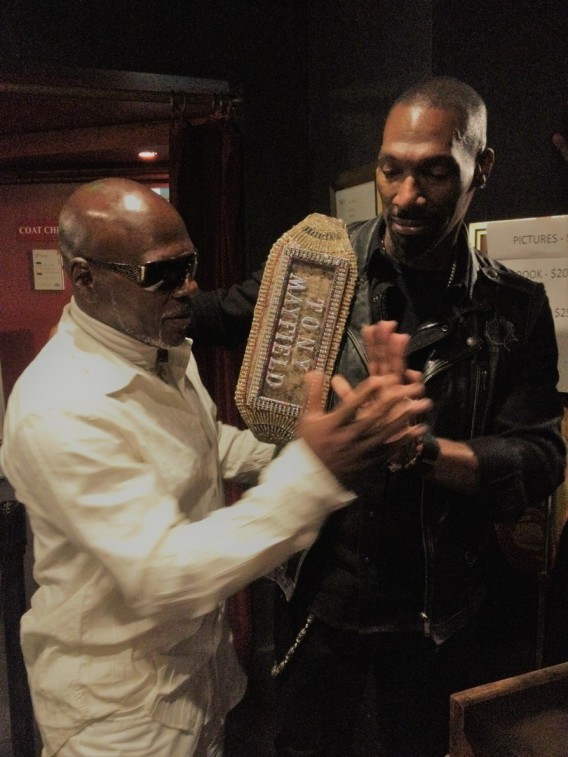

John Witherspoon supports Tony Mayfield non-violent champion

Non-Violent Comedy Legend spent his valuable time with me on September 14, 2019. His last words he shared with me about his non-violent laughter for all to enjoy. RIP John Witherspoon October 29, 2019. PS: Deep appreciation

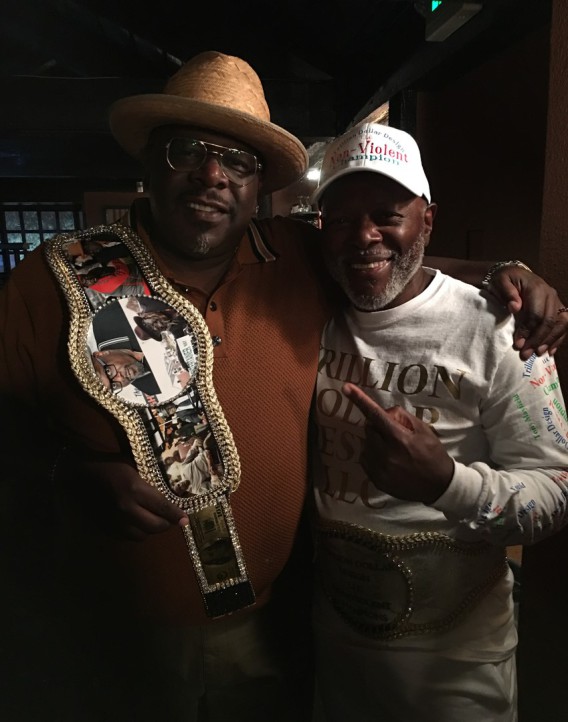

Special thanks to Cedric the Entertainer for accepting non-violent champion belt.

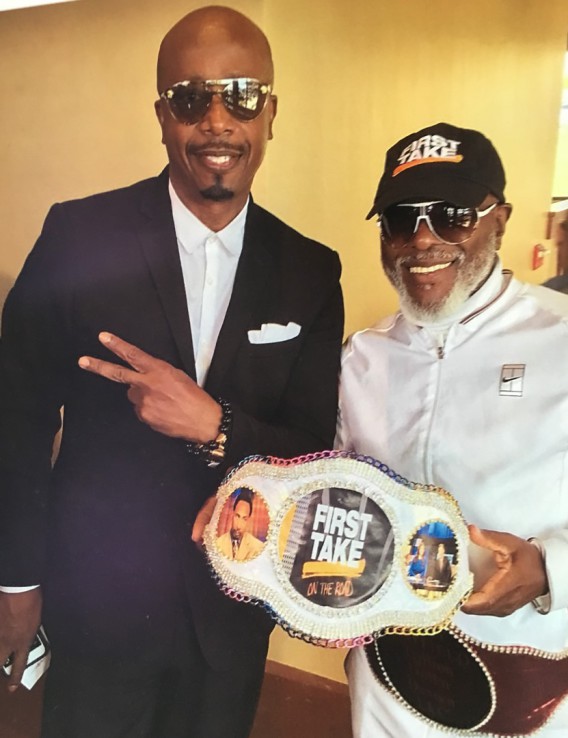

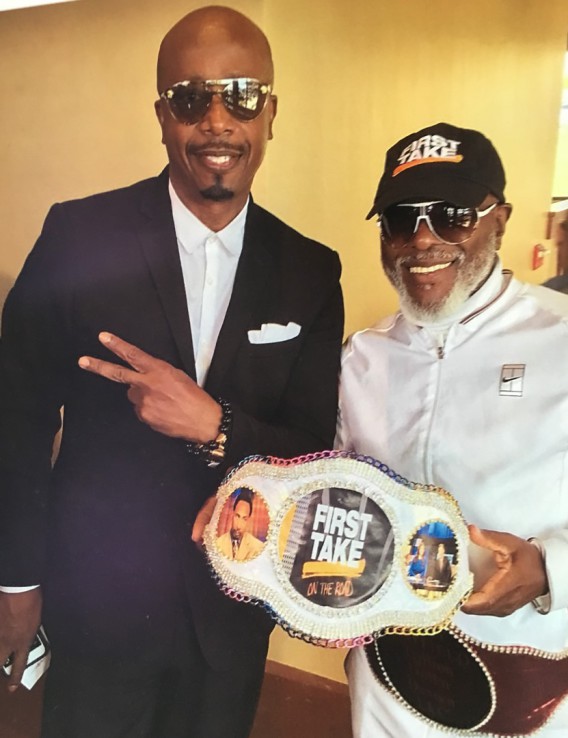

Ice Cube with the Non-Violent Championship Belt on the set of First Take. Special thanks.

Tony Mayfield Non-Violent Champion For Life

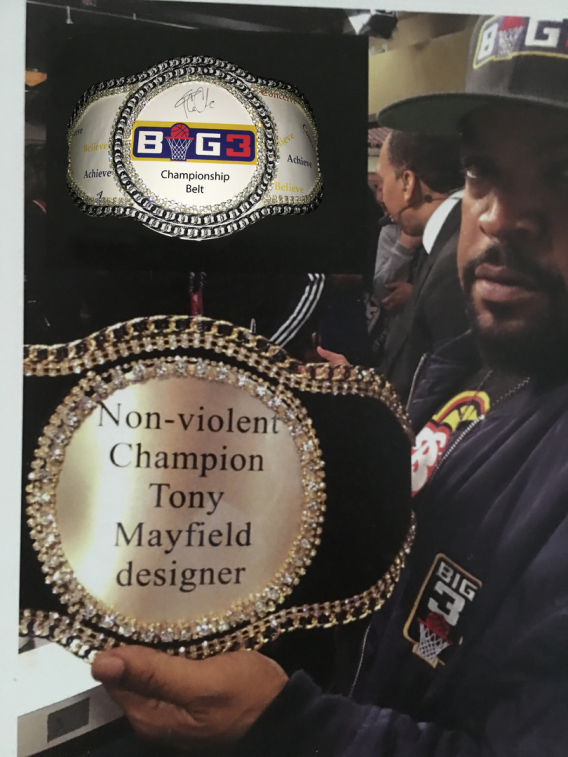

Non-violent champion Tony Mayfield goes to the Big 3 Championship at the Staples Center

After practice Stephen Jackson takes time out for non-violent champion Tony Mayfield

From the movie “The Wash” Tray Deee and non-violent champion Tony Mayfield

Special Thanks to Michael Rappaport

Non-violent champion Tony Mayfield makes appearance on the set of First Take

Non-Violent Championship Belts – Tony Mayfield, Designer

MC Hammer and Designer Tony Mayfield on the set of First Take

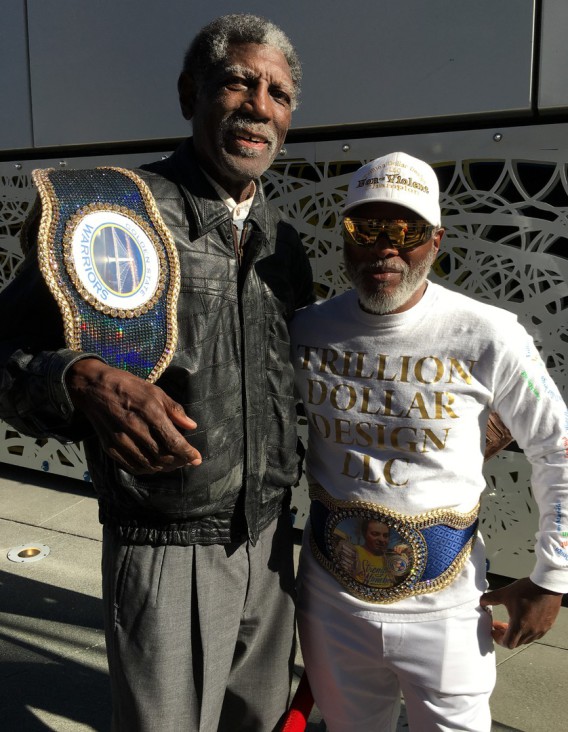

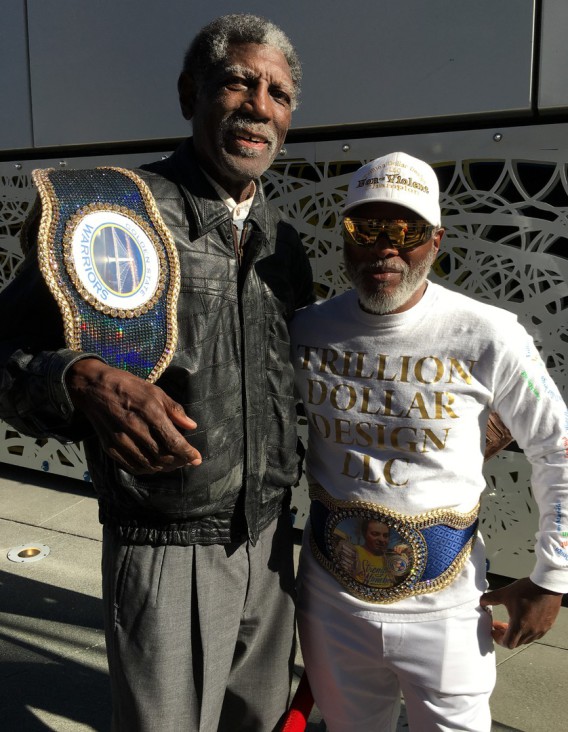

1974-1975 NBA Champion Living Legend Al Attles

Rick Welts, President, Holds Golden State Warriors 3X World Championship Belt

Designer Tony Mayfield

Warriors’ Owner Loves Trillion Dollar Design, LLC, Non-Violent Championship Belts

Warriors Hall of Famer Chris Mullin

Welcome Harry Davis of Gucci San Francisco to the Non-Violent Champions

Designer Tony Mayfield

Trillion Dollar Design, LLC, custom-made photo clocks. Contact us to order your personalized lifetime memory.

First Take Sports Analyst Max and Tony Mayfield after the show

First Take Championship Belt

Say it loud: Charlie Murphy!!!! Last appearance with him.

Special Thanks to Martin Lawrence

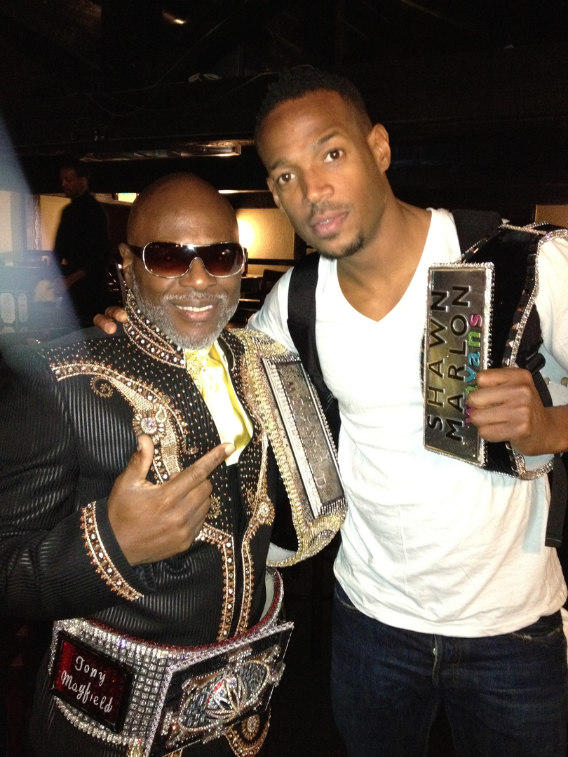

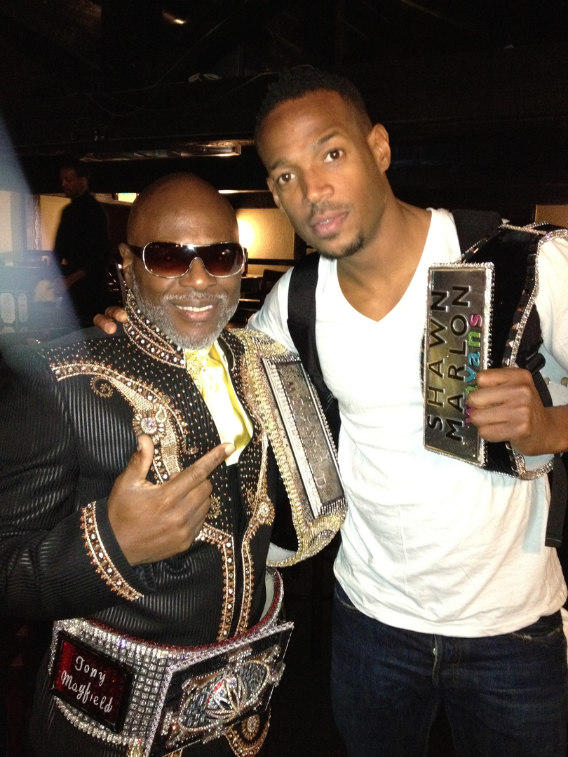

Special Thanks to Damon Wayans

Special Thanks to Marlon Wayans

Special Thanks to Sommore

Soulful R&B Singer Freddie Jackson

Thank you for visting our site.

as per our monitoring this Story originally appeared * : ) here → *

Trillion Dollar Design

5G Market are Going From $31 Billion in 2020 to $11 Trillion by 2026, Research Report by ReportsnReports

PUNE, India, Nov. 13, 2019 /PRNewswire/ — The 2019 study has 246 pages, 121 tables and figures. The leading vendors in the 5G market have invested in high-quality technology and processes to develop leading edge monitoring and digital triggering activation capability. 5G is the most disruptive force seen in centuries. 5G Market are going from $31 billion in 2020 to $11 trillion by 2026. It has more far reaching effect than a stronger military, than technology, than anything.

5G markets encompass virtualization, cloud, edge, and functional splits. As 5G networks come on line in 2020, they require increasing sophistication from mobile operators. The challenge going forward in mobile network buildout is to bring together a growing number of LTE and 5G radio access technologies. A range of connectivity services are needed. APIs are needed in each small cell to manage connectivity to a number of customer sensors that are implemented in different segments.

Get Free Sample Copy of 5G Market Research Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=2680586

The 5G sales at $31.3 billion in 2020 are forecast to reach $11.2 trillion in 2026. Networks spending has been transformed from macro cell tower dominance to 80% of spending on infrastructure and equipment for 5G. 5G supports wireless communications across short distances. All the indoor and outdoor places need to increase wireless coverage, providing significant market growth for 5G.

The digital economy, self-driving cars, drones, smart traffic lights, and smart connectivity of sensor enabled edge devices need more wireless coverage. According to Susan Eustis, leader of the team that prepared the research, “5G suppliers have a focus on broadband improvement. Power and performance are being improved. 5G improves the transmission coverage and density.”

This 5G coverage is needed as IoT, the Internet of things and smart phone video increase transmission needs.

Get Discount on this Research Report at https://www.reportsnreports.com/contacts/discount.aspx?name=2680586

Companies Profiled

Market Leaders:

Intel

Ericsson

Huawei

Nokia / Alcatel-Lucent

NEC

Qualcomm

Samsung

Fujitsu

ip.access

Market Participants:

ADT Inc

Advantech Co Ltd

Alphabet / Google

Amazon.com (AMZN)

AMS ag

Apple

AT&T

Baidu (BIDU)

BlueShift Memory

Broadcom

Cisco

Crown Castle (CCI)

Cypress Semiconductor

Dexcom Inc

Ericsson

Facebook (FB)

Garmin ltd

Huawei

IBM

IBM / Red Hat

Intel

Juniper Networks

Kensaq.com

Amazon

Netflix

Marvell Technology Group

Mavenir

Mellanox Technologies

Micron

Microsoft (MSFT)

NeoPhotonics 400G CFP8 PAM

Nokia

Nvidia Speeds and Feed

Qualcomm

Qorvo

Rackspace

Rogers Communications

Salesforce (CRM)

Samsung

Sensata Technology

Silicon Laboratories

Skyworks Solutions

SoftBank

Telus

Tencent (TCEHY)

Tesla

Toyota and Panasonic

Tsinghua

Twilio

Verizon

Xilinx

Direct Purchase of 5G Market, Extending Human Eyesight, Extending Human Senses Forecasts, Worldwide, 2020 to 2026 Report at https://www.reportsnreports.com/purchase.aspx?name=2680586

Table of Contents:

5G Executive Summary

- 5G Market Description and Market Dynamics

- 5G Market Leaders and Forecasts

- 5G Market Analysis

- 5G Research and Technology

- 5G Company Profiles

Another Related Research Report The Private LTE & 5G Network Ecosystem: 2020 – 2030 – Opportunities, Challenges, Strategies, Industry Verticals & Forecasts – Report presents an in-depth assessment of the private LTE and 5G network ecosystem including market drivers, challenges, enabling technologies, vertical market opportunities, applications, key trends, standardization, spectrum availability/allocation, regulatory landscape, deployment case studies, opportunities, future roadmap, value chain, ecosystem player profiles and strategies. The report also presents forecasts for private LTE and 5G network infrastructure investments from 2020 till 2030. The forecasts cover three submarkets, two air interface technologies, 10 vertical markets and six regions.

Expected to reach $4.7 Billion in annual spending by the end of 2020, private LTE and 5G networks are increasingly becoming the preferred approach to deliver wireless connectivity for critical communications, industrial IoT, enterprise & campus environments, and public venues. The market will further grow at a CAGR of 19% between 2020 and 2023, eventually accounting for nearly $8 Billion by the end of 2023. Order a Copy of this Research Report at https://www.reportsnreports.com/purchase.aspx?name=2640367

About Us:

ReportsnReports.com is your single source for all market research needs. Our database includes 100,000+ market research reports from over 95 leading global publishers & in-depth market research studies of over 5000 micro markets. With comprehensive information about the publishers and the industries for which they publish market research reports, we help you in your purchase decision by mapping your information needs with our huge collection of reports. We provide 24/7 online and offline support to our customers.

Contact:

Vishal Kalra

Tower B5, office 101,

Magarpatta SEZ,

Hadapsar, Pune-411013, India

+1-888-391-5441

[email protected]

Connect With Us on:

Facebook: https://www.facebook.com/ReportsnReports/

LinkedIn: https://www.linkedin.com/company/reportsnreports

Twitter: https://twitter.com/marketsreports

RSS/Feeds: http://www.reportsnreports.com/feed/l-latestreports.xml

SOURCE ReportsnReports

as per our monitoring this Story originally appeared * : ) here → *

5G Market are Going From $31 Billion in 2020 to $11 Trillion by 2026, Research Report by ReportsnReports

Mitch McConnell Blames the Poor for Trump’s Trillion-Dollar Deficit

In a life filled with uncertainty, there are a few things you can always count on. First, that death comes for everyone. Second, that the current president of the United States will call an adult-film star he paid to keep quiet about an alleged affair “horseface” on social media. And third, that after passing a $1.5 trillion tax cut they insisted would pay for itself and then some, Republicans would blame social services like Medicare, Medicaid, and Social Security for exploding deficits and debt and insist that such “entitlements,” sadly, have got to go.

As a reminder, the Grand Old Party put on a big show of pretending to care about “fiscal responsibility” when Barack Obama was in office and mouth-watering tax cuts weren’t on the line. “Only one thing can save this country, and that’s to get a handle on this deficit-and-debt issue,” Majority Leader Mitch McConnell insisted after the 44th president won his second term. “The federal fiscal burden threatens the security, liberty, and independence of our nation,” the Republican Party platform warned in 2016. “You’re bankrupting our grandchildren!” was a common refrain, as were proclamations such as, “I won’t endorse a bill that adds one penny to the deficit!” Then Donald Trump won the election, and all those worries about crippling the next generation and the country going to hell in a handbasket vanished overnight—almost as though it was feigned in the first place!—with Republicans not only demanding that Congress pass a deficit-busting piece of legislation so that the president and his children could pay even fewer taxes than they already do, but maintaining—laws of math, physics, time and space be damned—that the bill once known as the “Cut Cut Cut Act” would actually help shrink the deficit.

But as the G.O.P. surely knew, that was never going to happen. Instead, as we learned this week, the U.S. budget deficit increased to $779 billion for the fiscal year, a 17 percent increase from the year prior, which is extra bad considering the economy is doing well, a scenario in which the federal deficit typically falls. Luckily, Mitch McConnell knows exactly who and what to blame:

“It’s disappointing, but it’s not a Republican problem,” McConnell said Tuesday in an interview with Bloomberg News when asked about the rising deficits and debt. “It’s a bipartisan problem: unwillingness to address the real drivers of the debt by doing anything to adjust those programs to the demographics of America in the future.”

The “real” drivers of debt, according to McConnell, are “Medicare, Social Security, and Medicaid,” “entitlements” from which the Senate majority leader would cut off the old and poor if only he could get Democrats to sign on. (That’s probably unlikely to happen, given Nancy Pelosi’s statement today that, “Like clockwork, Republicans in Congress are setting in motion their plan to destroy the Medicare, Medicaid, and Social Security that seniors and families rely on, just months after they exploded the deficit by $2 trillion with their tax scam for the rich,” and Chuck Schumer’s that suggesting cuts to “middle-class programs like Medicare, Social Security, and Medicaid as the only fiscally responsible solution to solve the debt problem is nothing short of gaslighting.”)

McConnell’s take on the situation echoes that of the White House, whose National Economic Council director, Larry Kudlow, said last month that he doesn’t “buy” the argument that tax cuts increase the deficit, and that the real problem is “principally spending too much.” (Kudlow, who has a penchant for never being right about anything, also claimed in June that the deficit was “coming down rapidly.”) Treasury Secretary Steven Mnuchin was even more blunt while telling his assessment to CNN last week, “People are going to want to say the deficit is because of the tax cuts. That’s not the real story.” (The report out of his own department suggests otherwise.) Incidentally, in June, reports circulated that the Trump administration was trying to figure out a workaround to cut another $100 billion from the tax bills of the wealthiest Americans, and in late September, House Republicans passed a piece of legislation that would add more than $600 billion to the debt over the next decade. Neither measure will come to fruition, but on the off-chance that one does, we’re sure McConnell stands ready to blame the poor and elderly freeloaders who clearly hate America.

If you would like to receive the Levin Report in your inbox daily, click here to subscribe.

as per our monitoring this Story originally appeared * : ) here → *

Mitch McConnell Blames the Poor for Trump’s Trillion-Dollar Deficit

The Nonprofit Sector in Brief 2018

12.13.2018

Brice McKeever

- ######

- #Background Setup

- ######

- library(httr)

- library(tidyverse)

- library(stringr)

- library(RCurl)

- library(reshape2)

- library(RColorBrewer)

- library(extrafont)

- library(knitr)

- library(foreign)

- library(kableExtra)

- library(urbnthemes)

- library(grid)

- library(gridExtra)

- #set_urban_defaults()

- set_urban_defaults()

- ######

- #Download Raw NCCS Data

- ######

- #This code will use the following NCCS data sets, so import separately using defined functions, and save in the “Data” folder

- #Retrieve NCCS Data Archive download functions

- source(“NCCS_Code/Prep IRS BMF.R”)

- source(“NCCS_Code/Prep NCCS Core File.R”)

- #The following code will retrieve the stated data sets from the NCCS Data Archive.

- #This code is commented out in final to avoid repeated (and bandwidth intensive) downloads

- #IRS Business Master Files:

- #bm0601

- #bm0601 <- getbmffile("2006", "01")

- ##bm1106

- #bm1106 <- getbmffile("2011", "06")

- ##bm1502

- #bm1502 <- getbmffile("2015", "02")

- ##bm1602

- #bm1602 <- getbmffile("2016", "02")

- ##

- ##core2005pf

- #core2005pf <- getcorefile(2005, "pf")

- ##core2005pc

- #core2005pc <- getcorefile(2005, "pc")

- ##core2005co

- #core2005co <- getcorefile(2005, "co")

- #

- ##

- ##core2010pf

- #core2010pf <- getcorefile(2010, "pf")

- ##core2010pc

- #core2010pc <- getcorefile(2010, "pc")

- ##core2010co

- #core2010co <- getcorefile(2010, "co")

- #

- ##

- ##core2014pf

- #core2014pf <- getcorefile(2014, "pf")

- ##core2014pc

- #core2014pc <- getcorefile(2014, "pc")

- ##core2014co

- #core2014co <- getcorefile(2014, "co")

- #

- ##

- ##core2015pf

- #core2015pf <- getcorefile(2015, "pf")

- ##core2015pc

- #core2015pc <- getcorefile(2015, "pc")

- ##core2015co

- #core2015co <- getcorefile(2015, "co")

- ######

- #Import Index Tables

- ######

- #The NTEE Lookup file can be downloaded from: http://nccs-data.urban.org/data/misc/nccs.nteedocAllEins.csv

- #The following code assumes that it has been saved in the local “Data” folder

- #retrieve from CSV:

- nteedocalleins <- read_csv("Data/nteedocalleins.csv",

- col_types = cols_only(EIN = col_character(),

- NTEEFINAL = col_character()

- ))

- #Inflation Index

- #Load Inflation index table

- #Based on information from Consumer Price Index Table 24: “Historical Consumer Price Index for All Urban Consumers (CPI-U): U.S. city average, all items”

- #Updated April 2018, available at https://www.bls.gov/cpi/tables/supplemental-files/home.htm (Historical CPI-U)

- inflindex <- read.csv("External_Data/Inflation Index.csv", row.names =1, header = TRUE)

- #Create function to prepare and import selected BMF fields for analysis

- prepbmffile <- function(bmffilepath) {

- output <- read_csv(bmffilepath,

- col_types = cols_only(EIN = col_character(),

- NTEECC = col_character(),

- STATE = col_character(),

- OUTNCCS = col_character(),

- SUBSECCD = col_character(),

- FNDNCD = col_character(),

- CFILER = col_character(),

- CZFILER = col_character(),

- CTAXPER = col_character(),

- CTOTREV = col_double(),

- CASSETS = col_double()

- ))

- names(output) <- toupper(names(output))

- return(output)

- }

- #Create function to prepare and import selected NCCS Core PC/CO fields for analysis

- prepcorepcfile <- function(corefilepath) {

- output <- read_csv(corefilepath,

- col_types = cols_only(EIN = col_character(),

- OUTNCCS = col_character(),

- SUBSECCD = col_character(),

- FNDNCD = col_character(),

- TOTREV = col_double(),

- EXPS = col_double(),

- ASS_EOY = col_double(),

- GRREC = col_double()

- ))

- names(output) <- toupper(names(output))

- return(output)

- }

- #Create function to prepare and import selected NCCS Core PF fields for analysis

- prepcorepffile <- function(corefilepath) {

- output <- read_csv(corefilepath,

- col_types = cols_only(EIN = col_character(),

- OUTNCCS = col_character(),

- SUBSECCD = col_character(),

- FNDNCD = col_character(),

- P1TOTREV = col_double(),

- P1TOTEXP = col_double(),

- P2TOTAST = col_double()

- ))

- names(output) <- toupper(names(output))

- return(output)

- }

- ######

- #Import and Prepare NCCS Data files

- #Note: data has already been saved locally using above code

- ######

- ###

- #BMF Data

- ###

- #2005 BMF Data

- bmf2005 <-prepbmffile("Data/bm0601.csv")

- #2010 BMF Data

- bmf2010 <-prepbmffile("Data/bm1106.csv")

- #2014 BMF Data

- bmf2014 <-prepbmffile("Data/bm1502.csv")

- #2015 BMF Data

- bmf2015 <-prepbmffile("Data/bm1602.csv")

- ###

- #Core Data

- ###

- #

- #Core 2005 Data

- #

- #PC

- core2005pc <- prepcorepcfile("Data/core2005pc.csv")

- #CO

- core2005co <- prepcorepcfile("Data/core2005co.csv")

- #PF

- core2005pf <- prepcorepffile("Data/core2005pf.csv")

- #

- #Core 2010 Data

- #

- #PC

- core2010pc <- prepcorepcfile("Data/core2010pc.csv")

- #CO

- core2010co <- prepcorepcfile("Data/core2010co.csv")

- #PF

- core2010pf <- prepcorepffile("Data/core2010pf.csv")

- #

- #Core 2014 Data

- #

- #PC

- core2014pc <- prepcorepcfile("Data/core2014pc.csv")

- #CO

- core2014co <- prepcorepcfile("Data/core2014co.csv")

- #PF

- core2014pf <- prepcorepffile("Data/core2014pf.csv")

- #

- #Core 2015 Data

- #

- #PC

- core2015pc <- prepcorepcfile("Data/core2015pc.csv")

- #CO

- core2015co <- prepcorepcfile("Data/core2015co.csv")

- #PF

- core2015pf <- prepcorepffile("Data/core2015pf.csv")

- ######

- #Create Grouping Categories for Analysis by NTEE and Size

- ######

- ###

- #NTEE Groupings

- ###

- #Create NTEE grouping categories

- arts <- c("A")

- highered <- c("B4", "B5")

- othered <- c("B")

- envanimals <- c("C", "D")

- hospitals <- c('E20','E21','E22','E23','E24','F31','E30','E31','E32')

- otherhlth <- c("E", "F", "G", "H")

- humanserv <- c("I", "J", "K", "L", "M", "N", "O", "P")

- intl <- c("Q")

- pubben <- c("R", "S", "T", "U", "V", "W", "Y", "Z")

- relig <- c("X")

- #define function to join NTEE Master list and categorize organizations accordingly

- NTEEclassify <- function(dataset) {

- #merge in Master NTEE look up file

- dataset %

- left_join(nteedocalleins, by = “EIN”)

- #create NTEEGRP classifications

- dataset$NTEEGRP <- " "

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,1) %in% arts ] <- "Arts"

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,1) %in% othered ] <- "Other education"

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,2) %in% highered ] <- "Higher education"

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,1) %in% envanimals] <- "Environment and animals"

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,1) %in% otherhlth] <- "Other health care"

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,3) %in% hospitals] <- "Hospitals and primary care facilities"

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,1) %in% humanserv] <- "Human services"

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,1) %in% intl] <- "International"

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,1) %in% pubben] <- "Other public and social benefit"

- dataset$NTEEGRP[str_sub(dataset$NTEEFINAL,1,1) %in% relig] <- "Religion related"

- dataset$NTEEGRP[is.na(dataset$NTEEFINAL)] <- "Other public and social benefit"

- return(dataset)

- }

- ###

- #Expense Groupings

- ###

- #define function to classify organizations by expenses size

- EXPclassify <-function(dataset) {

- dataset$EXPCAT <- " "

- dataset$EXPCAT[dataset$EXPS<100000] <- "a. Under $100,000"

- dataset$EXPCAT[dataset$EXPS >= 100000 & dataset$EXPS< 500000] <- "b. $100,000 to $499,999"

- dataset$EXPCAT[dataset$EXPS >= 500000 & dataset$EXPS< 1000000] <- "c. $500,000 to $999,999"

- dataset$EXPCAT[dataset$EXPS >= 1000000 & dataset$EXPS< 5000000] <- "d. $1 million to $4.99 million"

- dataset$EXPCAT[dataset$EXPS >= 5000000 & dataset$EXPS< 10000000] <- "e. $5 million to $9.99 million"

- dataset$EXPCAT[dataset$EXPS >= 10000000] <- "f. $10 million or more"

- return(dataset)

- }

- ###

- #Apply Groupings to relevant data sets

- ###

- #NTEE

- core2005pc <- NTEEclassify(core2005pc)

- core2010pc <- NTEEclassify(core2010pc)

- core2014pc <- NTEEclassify(core2014pc)

- core2015pc <- NTEEclassify(core2015pc)

- #Expenses

- core2005pc <-EXPclassify(core2005pc)

- core2010pc <-EXPclassify(core2010pc)

- core2014pc <-EXPclassify(core2014pc)

- core2015pc <-EXPclassify(core2015pc)

The Nonprofit Sector in Brief 2018: Public Charites, Giving, and Volunteering

by Brice S. McKeever

November 2018

This brief discusses trends in the number and finances of 501(c)(3) public charities and key findings on two important resources for the nonprofit sector: private charitable contributions and volunteering.

Back to topHighlights

- Approximately 1.56 million nonprofits were registered with the Internal Revenue Service (IRS) in 2015, an increase of 10.4 percent from 2005.

- The nonprofit sector contributed an estimated $985.4 billion to the US economy in 2015, composing 5.4 percent of the country’s gross domestic product (GDP).[1]

- Of the nonprofit organizations registered with the IRS, 501(c)(3) public charities accounted for just over three-quarters of revenue and expenses for the nonprofit sector as a whole ($1.98 trillion and $1.84 trillion, respectively) and just under two-thirds of the nonprofit sector’s total assets ($3.67 trillion).

- In 2017, total private giving from individuals, foundations, and businesses totaled $410.02 billion (Giving USA Foundation 2018), an increase of 3 percent from 2016 (after adjusting for inflation). According to Giving USA (2018) total charitable giving rose for the fourth consecutive year in 2017, making 2017 the largest single year for private charitable giving, even after adjusting for inflation.

- An estimated 25.1 percent of US adults volunteered in 2017, contributing an estimated 8.8 billion hours. This is a 1.6 percent increase from 2016. The value of these hours is approximately $195.0 billion.

Size and Scope of the Nonprofit Sector

- #Define Table 1 Function

- Table1 <- function(datayear) {

- ###

- #Step1: Pull from raw bmf data to get Number of registered organizations

- ###

- #Step1a: Create function to pull in BMF data

- byear <- function(datayear) {

- #get BMF file names:

- bmf1 <- as.character(paste("bmf", (datayear -10), sep =""))

- bmf2 <- as.character(paste("bmf", (datayear -5), sep =""))

- bmf3 <- as.character(paste("bmf", (datayear), sep =""))

- #for each BMF file name, run the following:

- bcomponent <- function(bmfnum, year_of_int){

- #get dataset

- bmf <- get(bmfnum)

- #calculate all registered nonprofits

- all %

- filter((OUTNCCS != “OUT”)) %>%

- summarize(

- year = as.character(year_of_int),

- “All registered nonprofits” = n()

- )

- #calculate all public charities

- pc %

- filter((FNDNCD != “02” & FNDNCD!= “03” & FNDNCD != “04”), (SUBSECCD == “03”|SUBSECCD== “3”), (OUTNCCS != “OUT”)) %>%

- summarize(

- year = as.character(year_of_int),

- “501(c)(3) public charities” = n()

- )

- #combine registered nonprofits and public charities

- combined %

- left_join(pc, by = “year”)

- #return combined file

- return(combined)

- }

- #run function for each year

- bcomp1 <-bcomponent(bmf1, (datayear -10))

- bcomp2 <-bcomponent(bmf2, (datayear -5))

- bcomp3 <-bcomponent(bmf3, datayear)

- #merge years

- total <- rbind(bcomp1, bcomp2, bcomp3)

- #return final

- return(total)

- }

- #Step 1b: run against year of interest:

- btest<- byear(datayear)

- ###

- #Step 2: pull correct core file years

- ###

- #Step 2a: function to pull correct years starting from base year:

- T1grab = function(yr) {

- output <- c(yr-10,

- yr-5,

- yr)

- return(list(output))

- }

- #Step 2b: pull the right years:

- T1years <-T1grab(datayear)

- #Step 2c: Function for individual years of core files

- T1Fin<- function(datayear) {

- pcname <- as.character(paste("core", datayear, "pc", sep =""))

- coname <- as.character(paste("core", datayear, "co", sep =""))

- pfname <- as.character(paste("core", datayear, "pf", sep =""))

- pcfile <- get(pcname)

- cofile <- get(coname)

- pffile <- get(pfname)

- pcfile <- if(datayear = 25000)) else filter(pcfile, ((GRREC >= 50000)|(TOTREV>50000)))

- cofile <- if(datayear = 25000)|(TOTREV>25000))) else filter(cofile, ((GRREC >= 50000)|(TOTREV>50000)))

- pc %

- filter((is.na(OUTNCCS)|OUTNCCS != “OUT”), (FNDNCD != “02” & FNDNCD!= “03” & FNDNCD != “04”)) %>%

- summarize(

- Reporting = n(),

- “Revenue ($ billions)” = round((sum(as.numeric(TOTREV), na.rm =TRUE))/1000000000, digits =2),

- “Expenses ($ billions)” = round((sum(as.numeric(EXPS), na.rm =TRUE))/1000000000, digits =2),

- “Assets ($ billions)” = round((sum(as.numeric(ASS_EOY), na.rm =TRUE))/1000000000, digits=2))

- pc <- melt(pc)

- colnames(pc)[2] <- "PC"

- co %

- filter((OUTNCCS != “OUT”)) %>%

- summarize(

- Reporting = n(),

- “Revenue ($ billions)” = round((sum(as.numeric(TOTREV), na.rm =TRUE))/1000000000, digits =2),

- “Expenses ($ billions)” = round((sum(as.numeric(EXPS), na.rm =TRUE))/1000000000, digits =2),

- “Assets ($ billions)” = round((sum(as.numeric(ASS_EOY), na.rm =TRUE))/1000000000, digits=2))

- co <- melt(co)

- colnames(co)[2] <- "CO"

- pf %

- filter(OUTNCCS != “OUT”) %>%

- summarize(

- Reporting = n(),

- “Revenue ($ billions)” = round((sum(as.numeric(P1TOTREV), na.rm =TRUE))/1000000000, digits =2),

- “Expenses ($ billions)” = round((sum(as.numeric(P1TOTEXP), na.rm =TRUE))/1000000000, digits =2),

- “Assets ($ billions)” = round((sum(as.numeric(P2TOTAST), na.rm =TRUE))/1000000000, digits=2))

- pf <- melt(pf)

- colnames(pf)[2] <- "PF"

- Table1 %

- left_join(co, by = “variable”) %>%

- left_join(pf, by = “variable”) %>%

- transmute(

- variable = variable,

- “Reporting nonprofits” = (PC+CO+PF),

- “Reporting public charities” = PC)

- Table1 <- melt(Table1)

- colnames(Table1)[2]= “Type”

- colnames(Table1)[3]= as.character(datayear)

- Table1$variable <-ifelse(Table1$variable == "Reporting" & Table1$Type == "Reporting nonprofits",

- “Reporting nonprofits”, as.character(Table1$variable))

- Table1$variable <-ifelse(Table1$variable == "Reporting" & Table1$Type == "Reporting public charities",

- “Reporting public charities”, as.character(Table1$variable))

- return(Table1)

- }

- #Step 2d: run core file function for each core file year:

- comp1 <- T1Fin(T1years[[1]][1])

- comp2 <- T1Fin(T1years[[1]][2])

- comp3 <- T1Fin(T1years[[1]][3])

- #Step 2e: join multiple core file years together

- Table1All %

- left_join(comp2, by = c(“Type”, “variable”)) %>%

- left_join(comp3, by = c(“Type”, “variable”))

- #Step 2f: drop intermediary column

- Table1All <- Table1All[-2]

- ###

- #Step 3 Merge with BMF data

- ###

- AllRegNonprofits<- data.frame("All registered nonprofits", btest[[2]][1], btest[[2]][2], btest[[2]][3])

- names(AllRegNonprofits) <- names(Table1All)

- AllPCs<- data.frame("501(c)(3) public charities", btest[[3]][1], btest[[3]][2], btest[[3]][3])

- names(AllPCs) <- names(Table1All)

- Table1All <- rbind(Table1All, AllRegNonprofits, AllPCs)

- ###

- #Step 4: Calculate change over time

- ###

- Table1All %

- mutate(

- ChangeA = round(((Table1All[, as.character(datayear-5)] – Table1All[, as.character(datayear-10)])/(Table1All[, as.character(datayear-10)]))

- *100, digits=1),

- ChangeB = round(((Table1All[, as.character(datayear)] – Table1All[, as.character(datayear-10)])/(Table1All[, as.character(datayear-10)]))

- *100, digits=1)

- )

- ###

- #Step 5: calculate inflation adjustments

- ###

- Table1All %

- mutate(

- Y1 = round(((Table1All[, as.character(datayear-10)] * inflindex[as.character(datayear),])/(inflindex[as.character(datayear-10),])), digits=3),

- Y2 = round(((Table1All[, as.character(datayear-5)] * inflindex[as.character(datayear),])/(inflindex[as.character(datayear-5),])), digits=3),

- Y3 = round(((Table1All[, as.character(datayear)] * inflindex[as.character(datayear),])/(inflindex[as.character(datayear),])), digits=3),

- ChangeAInfl = round(((Y2-Y1)/Y1)*100, digits = 1),

- ChangeBInfl = round(((Y3-Y1)/Y1)*100, digits = 1)

- )

- ###

- #Step 6: Format and prepare final table

- ###

- #Step 6a: remove intermediary columns

- Table1All[7:9] <- list(NULL)

- #Step 6b: reorder columns to fit Nonprofit Sector in Brief

- Table1All <- Table1All[, c(1,2,3,5,7,4,6,8)]

- #Step 6c: omit numerical count columns from inflation adjustments

- Table1All[[5]][1] <- "–"

- Table1All[[5]][5] <- "–"

- Table1All[[8]][1] <- "–"

- Table1All[[8]][5] <- "–"

- Table1All[[5]][9] <- "–"

- Table1All[[5]][10] <- "–"

- Table1All[[8]][9] <- "–"

- Table1All[[8]][10] <- "–"

- #Step 6d: rename columns

- colnames(Table1All)[1] <- ""

- colnames(Table1All)[4] <- paste("% change, ", as.character(datayear -10), "u2013", as.character(datayear – 5), sep = "")

- colnames(Table1All)[5] <- paste("% change, ", as.character(datayear -10), "u2013", as.character(datayear – 5), " (inflation adjusted)", sep = "")

- colnames(Table1All)[7] <- paste("% change, ", as.character(datayear -10), "u2013", as.character(datayear ), sep = "")

- colnames(Table1All)[8] <- paste("% change, ", as.character(datayear -10), "u2013", as.character(datayear ), " (inflation adjusted)", sep = "")

- #Step6e: reorder rows

- Table1All <- Table1All[c(9,1,2,3,4,10,5,6,7,8),]

- #Step 6f: return final output

- return(Table1All)

- }

- #Create Table 1 based on 2015 data

- Table1_2015 <-Table1(params$NCCSDataYr)

- write.csv(Table1_2015, “Tables/NSiB_Table1.csv”)

- #Define Table 1 Current Growth Function (Appendix Table Showing only most recent growth)

- Table1CurGrowth <- function(datayear) {

- ###

- #Step1: Pull from raw BMF data to get Number of registered organizations

- ###

- #Step1a: Create function

- byear <- function(datayear) {

- #get BMF file names:

- bmf1 <- as.character(paste("bmf", (datayear -1), sep =""))

- bmf2 <- as.character(paste("bmf", (datayear), sep =""))

- #for each BMF file name, run the following:

- bcomponent <- function(bmfnum, year_of_int){

- #get dataset

- bmf <- get(bmfnum)

- #calculate all registered nonprofits

- all %

- filter((OUTNCCS != “OUT”)) %>%

- summarize(

- year = as.character(year_of_int),

- “All registered nonprofits” = n()

- )

- #calculate all public charities

- pc %

- filter((FNDNCD != “02” & FNDNCD!= “03” & FNDNCD != “04”), (SUBSECCD == “03”|SUBSECCD== “3”), (OUTNCCS != “OUT”)) %>%

- summarize(

- year = as.character(year_of_int),

- “501(c)(3) public charities” = n()

- )

- #combine registered nonprofits and public charities

- combined %

- left_join(pc, by = “year”)

- #return combined file

- return(combined)

- }

- #run function for each year

- bcomp1 <-bcomponent(bmf1, (datayear -1))

- bcomp2 <-bcomponent(bmf2, (datayear))

- #merge years

- total <- rbind(bcomp1, bcomp2)

- #return final

- return(total)

- }

- #Step 1b: run against year of interest:

- btest<- byear(datayear)

- ###

- #Step 2: Pull NCCS Core File data

- ###

- #Step 2a: function to pull correct years starting from base year:

- T1grab = function(yr) {

- output <- c(yr-1,

- yr)

- return(list(output))

- }

- #Step 2b: pull the right years:

- T1years <-T1grab(datayear)

- #Step 2c: Function for individual years of core files

- T1Fin<- function(datayear) {

- pcname <- as.character(paste("core", datayear, "pc", sep =""))

- coname <- as.character(paste("core", datayear, "co", sep =""))

- pfname <- as.character(paste("core", datayear, "pf", sep =""))

- pcfile <- get(pcname)

- cofile <- get(coname)

- pffile <- get(pfname)

- pcfile <- if(datayear = 25000)) else filter(pcfile, ((GRREC >= 50000)|(TOTREV>50000)))

- cofile <- if(datayear = 25000)|(TOTREV>25000))) else filter(cofile, ((GRREC >= 50000)|(TOTREV>50000)))

- pc %

- filter((is.na(OUTNCCS)|OUTNCCS != “OUT”), (FNDNCD != “02” & FNDNCD!= “03” & FNDNCD != “04”)) %>%

- summarize(

- Reporting = n(),

- “Revenue ($ billions)” = round((sum(as.numeric(TOTREV), na.rm =TRUE))/1000000000, digits =2),

- “Expenses ($ billions)” = round((sum(as.numeric(EXPS), na.rm =TRUE))/1000000000, digits =2),

- “Assets ($ billions)” = round((sum(as.numeric(ASS_EOY), na.rm =TRUE))/1000000000, digits=2))

- pc <- melt(pc)

- colnames(pc)[2] <- "PC"

- co %

- filter((OUTNCCS != “OUT”)) %>%

- summarize(

- Reporting = n(),

- “Revenue ($ billions)” = round((sum(as.numeric(TOTREV), na.rm =TRUE))/1000000000, digits =2),

- “Expenses ($ billions)” = round((sum(as.numeric(EXPS), na.rm =TRUE))/1000000000, digits =2),

- “Assets ($ billions)” = round((sum(as.numeric(ASS_EOY), na.rm =TRUE))/1000000000, digits=2))

- co <- melt(co)

- colnames(co)[2] <- "CO"

- pf %

- filter(OUTNCCS != “OUT”) %>%

- summarize(

- Reporting = n(),

- “Revenue ($ billions)” = round((sum(as.numeric(P1TOTREV), na.rm =TRUE))/1000000000, digits =2),

- “Expenses ($ billions)” = round((sum(as.numeric(P1TOTEXP), na.rm =TRUE))/1000000000, digits =2),

- “Assets ($ billions)” = round((sum(as.numeric(P2TOTAST), na.rm =TRUE))/1000000000, digits=2))

- pf <- melt(pf)

- colnames(pf)[2] <- "PF"

- Table1 %

- left_join(co, by = “variable”) %>%

- left_join(pf, by = “variable”) %>%

- transmute(

- variable = variable,

- “Reporting nonprofits” = (PC+CO+PF),

- “Reporting public charities” = PC)

- Table1 <- melt(Table1)

- colnames(Table1)[2]= “Type”

- colnames(Table1)[3]= as.character(datayear)

- Table1$variable <-ifelse(Table1$variable == "Reporting" & Table1$Type == "Reporting nonprofits",

- “Reporting nonprofits”, as.character(Table1$variable))

- Table1$variable <-ifelse(Table1$variable == "Reporting" & Table1$Type == "Reporting public charities",

- “Reporting public charities”, as.character(Table1$variable))

- return(Table1)

- }

- #Step 2d: run core file function for each core file year:

- comp1 <- T1Fin(T1years[[1]][1])

- comp2 <- T1Fin(T1years[[1]][2])

- #Setp 2e: join multiple core file years together

- Table1CG %

- left_join(comp2, by = c(“Type”, “variable”))

- #Step 2f: drop intermediary column

- Table1CG <- Table1CG[-2]

- ####

- #Step 3: Merge with BMF data

- ###

- AllRegNonprofits<- data.frame("All registered nonprofits", btest[[2]][1], btest[[2]][2])

- names(AllRegNonprofits) <- names(Table1CG)

- AllPCs<- data.frame("501(c)(3) public charities", btest[[3]][1], btest[[3]][2])

- names(AllPCs) <- names(Table1CG)

- Table1CG <- rbind(Table1CG, AllRegNonprofits, AllPCs)

- ###

- #Step 4: Calculate change over time

- ###

- Table1CG %

- mutate(

- Change = round(((Table1CG[, as.character(datayear)] – Table1CG[, as.character(datayear-1)])/(Table1CG[, as.character(datayear-1)]))

- *100, digits=1)

- )

- ###

- #Step 5: calculate inflation adjustments

- ###

- Table1CG %

- mutate(

- Y1_InflAdj = round(((Table1CG[, as.character(datayear-1)] * inflindex[as.character(datayear),])/(inflindex[as.character(datayear-1),])), digits=3),

- Y2_InflAdj = round(((Table1CG[, as.character(datayear)] * inflindex[as.character(datayear),])/(inflindex[as.character(datayear),])), digits=3),

- ChangeInfl = round(((Y2_InflAdj-Y1_InflAdj)/Y1_InflAdj)*100, digits = 1)

- )

- ###

- #Step 6: Format and prepare final table

- ###

- #Step 6a: omit numerical count columns from inflation adjustments

- Table1CG[[5]][1] <- "–"

- Table1CG[[5]][5] <- "–"

- Table1CG[[5]][9] <- "–"

- Table1CG[[5]][10] <- "–"

- Table1CG[[6]][1] <- "–"

- Table1CG[[6]][5] <- "–"

- Table1CG[[6]][9] <- "–"

- Table1CG[[6]][10] <- "–"

- Table1CG[[7]][1] <- "–"

- Table1CG[[7]][5] <- "–"

- Table1CG[[7]][9] <- "–"

- Table1CG[[7]][10] <- "–"

- #Step 6b: rename columns

- colnames(Table1CG)[1] <- ""

- colnames(Table1CG)[4] <- paste("% change, ", as.character(datayear -1), "u2013", as.character(datayear), sep = "")

- colnames(Table1CG)[7] <- paste("% change, ", as.character(datayear -1), "u2013", as.character(datayear), " (inflation adjusted)", sep = "")

- #Step 6c: reorder rows

- Table1CG <- Table1CG[c(9,1,2,3,4,10,5,6,7,8),]

- #Step 6d: return final output

- return(Table1CG)

- }

- #Create Table 1 Current Growth (2014-2015) based on 2015 data

- Table1CG_2015 <- Table1CurGrowth(params$NCCSDataYr)

- write.csv(Table1CG_2015, “Tables/NSiB_Table1_Appendix_Current_Growth.csv”)

All Nonprofit Organizations

Number

From 2005 to 2015, the number of nonprofit organizations registered with the IRS rose from 1.41 million to 1.56 million, an increase of 10.4 percent. These 1.56 million organizations comprise a diverse range of nonprofits, including art, health, education, and advocacy nonprofits; labor unions; and business and professional associations. This broad spectrum, however, only includes registered nonprofit organizations; the total number of nonprofit organizations operating in the United States is unknown. Religious congregations and organizations with less than $5,000 in gross receipts are not required to register with the IRS, although many do.[2] These unregistered organizations expand the scope of the nonprofit sector beyond the 1.56 million organizations this brief focuses on.

Finances

Approximately 34 percent of nonprofits registered with the IRS in 2015 were required to file a Form 990, Form 990-EZ, or Form 990-PF.[3] These reporting nonprofits identified $2.54 trillion in revenues and $5.79 trillion in assets (table 1).[4] Between 2005 and 2015, reporting nonprofits experienced positive financial growth. Both revenues and assets grew faster than GDP; after adjusting for inflation revenues grew 28.4 percent and assets grew 36.2 percent, compared with 13.6 percent growth for national GDP during the same period. Expenses grew 31.8 percent between2005 and 2015. In the short term, after adjusting for inflation, revenues grew 4.1 percent from $ 2.44 trillion in 2014 to $2.54 in 2015; assets increased 3.2 percent from $5.61 trillion to $5.79. Expenses also grew from $2.25 trillion in 2014 to $2.36 in 2015, an increase of 5 percent.

TABLE 1

Size and Scope of the Nonprofit Sector, 2005–2015

- #Display Table 1

- options(knitr.kable.NA =””)

- kable(Table1_2015, format.args = list(decimal.mark = ‘.’, big.mark = “,”),

- “html”,

- row.names = FALSE,

- align = “lccccccc”) %>%

- kable_styling(“hover”, full_width = F) %>%

- row_spec(c(1,6), bold = T ) %>%

- row_spec(3:5, italic = T) %>%

- row_spec(8:10, italic = T) %>%

- add_indent(c(3,4,5,8,9,10))

| 2005 | 2010 | % change, 2005–2010 | % change, 2005–2010 (inflation adjusted) | 2015 | % change, 2005–2015 | % change, 2005–2015 (inflation adjusted) | |

|---|---|---|---|---|---|---|---|

| All registered nonprofits | 1,414,343.00 | 1,493,407.00 | 5.6 | — | 1,561,616.00 | 10.4 | — |

| Reporting nonprofits | 552,115.00 | 514,494.00 | -6.8 | — | 531,026.00 | -3.8 | — |

| Revenue ($ billions) | 1,632.58 | 2,052.79 | 25.7 | 12.6 | 2,544.52 | 55.9 | 28.4 |

| Expenses ($ billions) | 1,476.80 | 1,931.02 | 30.8 | 17.1 | 2,361.45 | 59.9 | 31.8 |

| Assets ($ billions) | 3,500.91 | 4,441.45 | 26.9 | 13.6 | 5,785.56 | 65.3 | 36.2 |

| 501(c)(3) public charities | 847,946.00 | 979,883.00 | 15.6 | — | 1,088,447.00 | 28.4 | — |

| Reporting public charities | 312,778.00 | 293,265.00 | -6.2 | — | 314,744.00 | 0.6 | — |

| Revenue ($ billions) | 1,173.21 | 1,509.43 | 28.7 | 15.2 | 1,978.52 | 68.6 | 39 |

| Expenses ($ billions) | 1,077.37 | 1,450.74 | 34.7 | 20.6 | 1,838.81 | 70.7 | 40.6 |

| Assets ($ billions) | 2,065.18 | 2,671.86 | 29.4 | 15.9 | 3,668.59 | 77.6 | 46.4 |

Sources: Urban Institute, National Center for Charitable Statistics, Core Files (2005, 2010, and 2015); and the Internal Revenue Service Business Master Files, Exempt Organizations (2006–16).

Notes: Reporting public charities include only organizations that both reported (filed IRS Forms 990) and were required to do so (had $25,000 or more in gross receipts in 2005 and more than $50,000 in gross receipts in 2010 and 2015). Organizations that had their tax-exempt status revoked for failing to file a financial return for three consecutive years have been removed from the 2015 nonprofit total. Foreign organizations, government-associated organizations, and organizations without state identifiers have also been excluded. Unless noted, all amounts are in current dollars and are not adjusted for inflation.

Public Charities

Number

Public charities are the largest category of the more than 30 types of tax-exempt nonprofit organizations defined by the Internal Revenue Code. Classified under section 501(c)(3) (along with private foundations), public charities include arts, culture, and humanities organizations; education organizations; health care organizations; human services organizations; and other types of organizations to which donors can make tax-deductible donations. In 2015, about 1.09 million organizations were classified as public charities, composing about two-thirds of all registered nonprofits. Between 2005 and 2015, the number of public charities grew 28.4 percent, faster than the growth of all registered nonprofits (10.4 percent). The number of registered public charities also grew faster than other nonprofit subgroups during the decade, including private foundations, which grew by only 0.1 percent, and 501(c)(4) organizations, which declined 28 percent. Consequently, public charities made up a larger share of the nonprofit sector in 2015 (69.7 percent) than in 2005 (60 percent).

The number of reporting public charities required to file a Form 990 or Form 990-EZ grew slightly between 2014 and 2015, showing an increase of 2.2 percent.

Finances

Almost three-fifths (59.3 percent) of all nonprofit organizations reporting to the IRS in 2015 were public charities. Accounting for more than three-quarters of revenue and expenses for the nonprofit sector, public charities reported $1.98 trillion in revenues and $1.84 trillion in expenses. Assets held by public charities accounted for just under two-thirds of the sector’s total ($3.67 trillion).

Size

- #create Figure 1 Underlying table

- Fig1Table <- function(datayear) {

- #select core file by year

- file <- c(paste("core", datayear, "pc", sep =""))

- #get core file

- dataset <- get(file)

- #filter out organizations below minimum filing threshold for 990-EZ

- dataset <- if(datayear = 25000)|(TOTREV>25000))) else filter(dataset, ((GRREC >= 50000)|(TOTREV>50000)))

- #create table

- expstable %

- #filter by GRREC over threshold, not out, and FNDNCD != 2,3,4

- filter(((GRREC >= 50000)|(TOTREV>50000)), (OUTNCCS != “OUT”), (FNDNCD != “02” & FNDNCD!= “03” & FNDNCD != “04”)) %>%

- #group by exps cat

- group_by(EXPCAT) %>%

- #create summary values

- summarize(

- number_orgs = n(),

- total_expenses = round((sum(EXPS, na.rm =TRUE)/1000000000), digits =2)

- ) %>%

- #drop old variables, keep only categories and proportions

- mutate(

- year_of_data = as.character(datayear),

- EXPCAT = EXPCAT,

- “Public charities” = round(((number_orgs/sum(number_orgs))*100),digits=1),

- “Total expenses” = round(((total_expenses/sum(total_expenses))*100),digits=1)

- )

- #return output

- return(expstable)}

- #Create figure 1 Based on 2015 data

- Figure1_2015 <- Fig1Table(params$NCCSDataYr)

- write.csv(Figure1_2015, “Figures/NSiB_Figure1_Table.csv”)

Even after excluding organizations with gross receipts below the $50,000 filing threshold, small organizations composed the majority of public charities in 2015. As shown in figure 1 below, 66.9 percent had less than $500,000 in expenses (210,670 organizations); they composed less than 2 percent of total public charity expenditures ($32.3 billion). Though organizations with $10 million or more included just 5.3 percent of total public charities (16,556 organizations), they accounted for 87.7 percent of public charity expenditures ($1.6 trillion).

FIGURE 1

Number and Expenses of Reporting Public Charities as a Percentage of All Reporting Public Charities and Expenses

- #Create and Display Figure For 2015 Data

- Fig1Plot <- function(expstable) {

- #select relevant fields

- expstable <- expstable[,c("year_of_data", "EXPCAT", "Public charities", "Total expenses")]

- #plot graph

- Fig1%

- #shift from wide to long

- melt() %>%

- #create graph

- ggplot(aes(EXPCAT, value, fill=variable))+

- geom_bar(stat=”identity”, position=”dodge”) +

- geom_text(aes(EXPCAT, value, label=formatC(round(value,1), format = ‘f’, digits =1)),

- vjust=-1,

- position = position_dodge(width=1),

- size =3) +

- #labs(

- #title = “Figure 1”,

- #subtitle = paste(“Number and Expenses of Reporting Public Charities as a Percentage nof All Reporting Public Charities and Expenses, “, expstable$year_of_data[1], sep =””),

- #caption = paste(“Urban Institute, National Center for Charitable Statistics, Core Files (Public Charities, “

- #, expstable$year_of_data[1], “)”, sep =””)) +

- theme(axis.title.y = element_blank(),

- axis.text.y = element_blank(),

- axis.ticks.y = element_blank(),

- axis.title.x = element_blank(),

- panel.grid = element_blank()) +

- scale_y_continuous(expand = c(0, 0), limits = c(0,105)) +

- scale_x_discrete(labels = c(“Under $100,00”, “$100,000 to n$499,999”, “$500,000 to n$999,999”, “$1 million to n$4.99 million”,

- “$5 million to n$9.99 million”, “$10 million nor more”))

- UrbCaption <- grobTree(

- gp = gpar(fontsize = 8, hjust = 1),

- textGrob(label = “I N S T I T U T E”,

- name = “caption1”,

- x = unit(1, “npc”),

- y = unit(0, “npc”),

- hjust = 1,

- vjust = 0),

- textGrob(label = “U R B A N “,

- x = unit(1, “npc”) – grobWidth(“caption1”) – unit(0.01, “lines”),

- y = unit(0, “npc”),

- hjust = 1,

- vjust = 0,

- gp = gpar(col = “#1696d2”)))

- grid.arrange(Fig1, UrbCaption, ncol = 1, heights = c(30, 1))

- }

- Fig1Plot(Figure1_2015)

Source: Urban Institute, National Center for Charitable Statistics, Core Files (Public Charities, 2015)

Type

- #Create Table 2 Function

- Table2 <- function(datayear) {

- #select core file based on year

- file <- c(paste("core", datayear, "pc", sep =""))

- #get core file

- dataset <- get(file)

- #filter out organizations below minimum filing threshold for 990-EZ

- dataset <- if(datayear = 25000)|(TOTREV>25000))) else filter(dataset, ((GRREC >= 50000)|(TOTREV>50000)))

- #create table

- Table2%

- filter((OUTNCCS != “OUT”), (FNDNCD != “02” & FNDNCD!= “03” & FNDNCD != “04”)) %>%

- group_by(NTEEGRP) %>%

- summarize(

- Number_of_Orgs = n(),

- Revenue = round((sum(TOTREV, na.rm =TRUE))/1000000000, digits =1),

- Expenses = round((sum(EXPS, na.rm =TRUE))/1000000000, digits =1),

- Assets = round((sum(ASS_EOY, na.rm =TRUE))/1000000000, digits=1)) %>%

- mutate(

- Revenue_PCT = round((Revenue/sum(Revenue)) *100, digits =1),

- Expenses_PCT = round((Expenses/sum(Expenses)) *100, digits =1),

- Assets_PCT = round((Assets/sum(Assets)) *100, digits =1),

- Numbers_PCT = round((Number_of_Orgs/sum(Number_of_Orgs)) *100, digits =1)

- )

- #reorder columns

- Table2 <- Table2[,c("NTEEGRP", "Number_of_Orgs","Numbers_PCT","Revenue","Expenses", "Assets", "Revenue_PCT", "Expenses_PCT","Assets_PCT")]

- #Add total row

- myNumCols <- which(unlist(lapply(Table2, is.numeric)))

- Table2[(nrow(Table2) + 1), myNumCols] <- colSums(Table2[, myNumCols], na.rm=TRUE)

- Table2$NTEEGRP[11] = “All public charities”

- #add All Ed and All health rows

- Table2[12,1] = “Education”

- Table2[12,2:9] <- Table2[3,2:9] + Table2[7,2:9]

- Table2[13,1] = “Health”

- Table2[13,2:9] <- Table2[4,2:9] + Table2[8,2:9]

- #reorder table with new rows

- t2order <- c("All public charities", "Arts", "Education", "Higher education", "Other education", "Environment and animals",

- “Health”, “Hospitals and primary care facilities”, “Other health care”, “Human services”,

- “International”, “Other public and social benefit”, “Religion related”)

- Table2 %

- slice(match(t2order, NTEEGRP))

- #add year of data column

- Table2 <- cbind(year_of_data = as.character(datayear), Table2)

- return(Table2)

- }

- #Run for Table 2 for 2015 data

- Table2_2015 <- Table2(params$NCCSDataYr)

- write.csv(Table2_2015, “Tables/NSiB_Table2.csv”)

Table 2 below displays the 2015 distribution of public charities by type of organization. Human services groups—such as food banks, homeless shelters, youth services, sports organizations, and family or legal services—composed over one-third of all public charities (35.2 percent). They were more than twice as numerous as education organizations, the next-most prolific type of organization, which accounted for 17.2 percent of all public charities. Education organizations include booster clubs, parent-teacher associations, and financial aid groups, as well as academic institutions, schools, and universities. Health care organizations, though accounting for only 12.4 percent of reporting public charities, accounted for nearly three-fifths of public charity revenues and expenses in 2015. Education organizations accounted for 17.9 percent of revenues and 17.2 percent of expenses; human services, despite being more numerous, accounted for comparatively less revenue (11.8 percent of the total) and expenses (12.2 percent of the total). Hospitals, despite representing only 2.3 percent of total public charities (7,113 organizations), accounted for about half of all public charity revenues and expenses (49.4 and 50.4 percent, respectively).

TABLE 2

Number and Finances of Reporting Public Charities by Subsector, 2015

- #Display Table 2

- kable(Table2_2015[c(2:10)], format.args = list(decimal.mark = ‘.’, big.mark = “,”),

- “html”,

- align = “lcccccccc”,

- col.names = c(“”, “Number”, “% of total”, “Revenues”, “Expenses”, “Assets”, “Revenues”, “Expenses”, “Assets”)) %>%

- kable_styling(“hover”, full_width = F) %>%

- row_spec(c(4,5,8,9), italic = T ) %>%

- row_spec(1, bold = T ) %>%

- add_indent(c(4,5,8,9)) %>%

- add_header_above(c(” ” = 3, “Dollar Total ($ billions)” = 3, “Percentage of Total” = 3))

| Dollar Total ($ billions) | Percentage of Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Number | % of total | Revenues | Expenses | Assets | Revenues | Expenses | Assets | |

| All public charities | 314,744 | 100.0 | 1,978.6 | 1,838.9 | 3,668.6 | 100.0 | 100.0 | 100.1 |

| Arts | 31,429 | 10.0 | 40.6 | 35.7 | 127.9 | 2.1 | 1.9 | 3.5 |

| Education | 54,214 | 17.2 | 354.3 | 315.5 | 1,128.8 | 17.9 | 17.2 | 30.8 |

| Higher education | 2,153 | 0.7 | 230.9 | 207.4 | 736.3 | 11.7 | 11.3 | 20.1 |

| Other education | 52,061 | 16.5 | 123.4 | 108.1 | 392.5 | 6.2 | 5.9 | 10.7 |

| Environment and animals | 14,591 | 4.6 | 19.7 | 16.5 | 47.8 | 1.0 | 0.9 | 1.3 |

| Health | 38,861 | 12.4 | 1,160.5 | 1,102.3 | 1,574.1 | 58.7 | 59.9 | 42.9 |

| Hospitals and primary care facilities | 7,113 | 2.3 | 977.1 | 926.7 | 1,281.5 | 49.4 | 50.4 | 34.9 |

| Other health care | 31,748 | 10.1 | 183.4 | 175.6 | 292.6 | 9.3 | 9.5 | 8.0 |

| Human services | 110,801 | 35.2 | 234.1 | 224.0 | 357.1 | 11.8 | 12.2 | 9.7 |

| International | 6,927 | 2.2 | 38.5 | 34.5 | 43.2 | 1.9 | 1.9 | 1.2 |

| Other public and social benefit | 37,478 | 11.9 | 111.3 | 93.3 | 347.1 | 5.6 | 5.1 | 9.5 |

| Religion related | 20,443 | 6.5 | 19.6 | 17.1 | 42.6 | 1.0 | 0.9 | 1.2 |

Source: Urban Institute, National Center for Charitable Statistics, Core Files (Public Charities, 2015).

Note: Subtotals may not sum to totals because of rounding.

Growth

- #Create Table 3 function

- Table3 <- function(datayear) {

- #define years of interest

- T3grab = function(yr) {

- output <- c(paste("core", yr-10, "pc", sep = ""),

- paste(“core”, yr-5, “pc”, sep =””),

- paste(“core”, yr, “pc”, sep =””))

- return(list(output))

- }

- #define financial summarizer

- T3Fin <- function(dataset, year) {

- df <- get(dataset)

- #filter out organizations below minimum filing threshold for 990-EZ

- df <- if(year = 25000)|(TOTREV>25000))) else filter(df, ((GRREC >= 50000)|(TOTREV>50000)))

- output %

- filter((OUTNCCS != “OUT”), (FNDNCD != “02” & FNDNCD!= “03” & FNDNCD != “04”)) %>%

- group_by(NTEEGRP) %>%

- summarize(

- Number_of_Orgs = n(),

- Revenue = round((sum(as.numeric(TOTREV), na.rm =TRUE)/1000000000), digits =1),

- Expenses = round((sum(as.numeric(EXPS), na.rm =TRUE)/1000000000), digits=1),

- Assets = round((sum(as.numeric(ASS_EOY), na.rm =TRUE)/1000000000), digits=1)

- ) %>%

- mutate(

- Revenue = round((Revenue * inflindex[as.character(datayear),])/(inflindex[as.character(year),]), digits =1),

- Expenses = round((Expenses * inflindex[as.character(datayear),])/(inflindex[as.character(year),]), digits =1),

- Assets = round((Assets * inflindex[as.character(datayear),])/(inflindex[as.character(year),]), digits =1)

- )

- colnames(output)[2:5] <- paste(colnames(output)[2:5], year, sep = "_")

- return(output)

- }

- #run grabber for years of interest

- T3years <-T3grab(datayear)

- #pull each year

- comp1 <- T3Fin(T3years[[1]][1], (datayear-10))

- comp2 <- T3Fin(T3years[[1]][2], (datayear-5))

- comp3 <- T3Fin(T3years[[1]][3], datayear)

- #merge tables

- Table3 %

- left_join(comp2, by = “NTEEGRP”) %>%

- left_join(comp3, by = “NTEEGRP”)

- #reorder columns

- Table3IA <- Table3[, c(1,2,6,10,3,7,11,4,8,12,5,9,13)]

- #Add total row

- myNumCols <- which(unlist(lapply(Table3IA, is.numeric)))

- Table3IA[(nrow(Table3IA) + 1), myNumCols] <- colSums(Table3IA[, myNumCols], na.rm=TRUE)

- Table3IA$NTEEGRP[11] = “All public charities”

- #add All Ed and All health rows

- Table3IA[12,1] = “Education”

- Table3IA[12,2:13] <- Table3IA[3,2:13] + Table3IA[7,2:13]

- Table3IA[13,1] = “Health”

- Table3IA[13,2:13] <- Table3IA[4,2:13] + Table3IA[8,2:13]

- #reorder table with new rows

- t3order <- c("All public charities", "Arts", "Education", "Higher education", "Other education", "Environment and animals",

- “Health”, “Hospitals and primary care facilities”, “Other health care”, “Human services”,

- “International”, “Other public and social benefit”, “Religion related”)

- Table3IA %

- slice(match(t3order, NTEEGRP))

- #add year of data column

- Table3IA <- cbind(year_of_data = as.character(datayear), Table3IA)

- return(Table3IA)

- }

- #Run Table 3 for 2015 data

- Table3_2015 <- Table3(params$NCCSDataYr)

- write.csv(Table3_2015, “Tables/NSiB_Table3.csv”)

- ####################################################

- #Create Table 4 function

- Table4 <- function(datayear) {

- #start with table 3 data

- Table4 <- Table3(datayear)

- #calculate percentage change fields

- Table4 %

- mutate(

- RevAtoC = round(((Table4[,8] – Table4[,6] )/(Table4[,6] )) *100,1),

- RevAtoB = round(((Table4[,7]- Table4[,6] )/(Table4[,6] )) *100,1),

- RevBtoC = round(((Table4[,8]- Table4[,7] )/(Table4[,7] )) *100,1),

- ExpsAtoC =round(((Table4[,11] – Table4[,9] )/(Table4[,9] )) *100,1),

- ExpsAtoB =round(((Table4[,10]- Table4[,9] )/(Table4[,9] )) *100,1),

- ExpsBtoC =round(((Table4[,11]- Table4[,10] )/(Table4[,10] )) *100,1),

- AssAtoC = round(((Table4[,14] -Table4[,12] )/(Table4[,12] )) *100,1),

- AssAtoB = round(((Table4[,13]- Table4[,12] )/(Table4[,12] )) *100,1),

- AssBtoC = round(((Table4[,14]- Table4[,13])/(Table4[,13] ))*100,1)

- )

- #drop intermediary raw number columns

- Table4 <- Table4[-(3:14)]

- #rename columns by year

- colnames(Table4)[3] <- paste("Revenue", datayear-10, "u2013", datayear, sep = "_")

- colnames(Table4)[4] <- paste("Revenue", datayear-10, "u2013", datayear-5, sep = "_")

- colnames(Table4)[5] <- paste("Revenue", datayear-5, "u2013", datayear, sep = "_")

- colnames(Table4)[6] <- paste("Expenses", datayear-10, "u2013", datayear, sep = "_")

- colnames(Table4)[7] <- paste("Expenses", datayear-10, "u2013", datayear-5, sep = "_")

- colnames(Table4)[8] <- paste("Expenses", datayear-5, "u2013", datayear, sep = "_")

- colnames(Table4)[9] <- paste("Assets", datayear-10, "u2013", datayear, sep = "_")

- colnames(Table4)[10] <- paste("Assets", datayear-10, "u2013", datayear-5, sep = "_")

- colnames(Table4)[11] <- paste("Assets", datayear-5, "u2013", datayear, sep = "_")

- #return output

- return(Table4)

- }

- #Run Table 4 for 2015 data

- Table4_2015 <- Table4(params$NCCSDataYr)

- write.csv(Table4_2015,”Tables/NSiB_Table4.csv”)

The number of reporting public charities in 2015 was approximately 2.2 percent higher than the number in 2014. The total revenues, expenses, and assets for reporting public charities all increased between 2014 and 2015; after adjusting for inflation, revenues rose 5.6 percent, expenses rose 5.7 percent, and assets rose 4.2 percent.

These trends are indicative of larger growth in the sector: both the number and finances of organizations in the nonprofit sector have grown over the past 10 years. But this growth has differed by subsector and period (table 3). Subsectors experienced varying degrees of financial expansion: although all subsectors reported increases in revenue in 2015 compared with 2005 (even after adjusting for inflation), a few decreased in number of nonprofits, including arts, education (excluding higher education), health, and other public and social benefit organizations. Consequently, these organizations accounted for a slightly lower proportion of the total sector in 2015 (50.8 percent) than they did in 2005 (53.6 percent). The smallest subsectors (international and foreign affairs organizations and environment and animals organizations) saw the largest growth rates in the number of organizations, increasing 21.7 and 14.7 percent, respectively, from 2005 to 2015.

Financially, religion-related organizations had the largest proportional increase in both revenue and expenses, growing from $12.3 billion in revenue in 2005 to $19.6 billion in 2015 after adjusting for inflation (a change of 59.3 percent). Environment and animals organizations experienced similar growth, growing from $13 billion in revenue in 2005 to $19.7 billion in 2015 after adjusting for inflation (a change of 51.5 percent). Both types of organizations, however, still account for a very small proportion of overall nonprofit sector revenue in 2015, at just about 1 percent each. Health-related organizations, which account for a much larger proportion of overall sector finances (58.7, 59.9 and 42.9 percent, respectively, of revenues, expenses, and assets), also experienced considerable growth between 2005 and 2015. Revenues for hospitals and primary care facilities, in particular, increased from $689.3 billion in 2005 to $977.1 billion in 2015 after adjusting for inflation, by far the largest dollar growth of any subsector during this period. The growth for the health sector, $343.3 billion, accounts for over three-fifths of the growth of the entire nonprofit sector between 2005 and 2015 ($554.6 billion).

TABLE 3

Number, Revenues, and Assets of Reporting Public Charities by Subsector, 2005–2015 (adjusted for inflation)

- #Display Table 3

- kable(Table3_2015[c(2:14)], format.args = list(decimal.mark = ‘.’, big.mark = “,”),

- “html”,

- col.names = c(“”, “2005”, “2010”, “2015”, “2005”, “2010”, “2015”, “2005”, “2010”, “2015”, “2005”, “2010”, “2015”),

- align = “lcccccccccccc”#,

- )%>%

- kable_styling(“hover”, full_width = F) %>%

- row_spec(c(4,5,8,9), italic = T ) %>%

- row_spec(1, bold = T ) %>%

- add_indent(c(4,5,8,9)) %>%

- add_header_above(c(” “, “Number of Organizations” = 3, “Revenue ($ billions)” = 3, “Expenses ($ billions)” = 3, “Assets ($ billions)” = 3))

| Number of Organizations | Revenue ($ billions) | Expenses ($ billions) | Assets ($ billions) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 | 2010 | 2015 | 2005 | 2010 | 2015 | 2005 | 2010 | 2015 | 2005 | 2010 | 2015 | |

| All public charities | 312,779 | 293,265 | 314,744 | 1,424.0 | 1,641.0 | 1,978.6 | 1,307.7 | 1,576.9 | 1,838.9 | 2,506.4 | 2,904.1 | 3,668.6 |

| Arts | 34,483 | 29,409 | 31,429 | 31.7 | 31.5 | 40.6 | 27.7 | 29.9 | 35.7 | 98.3 | 105.3 | 127.9 |

| Education | 56,030 | 50,387 | 54,214 | 251.7 | 268.4 | 354.3 | 210.5 | 261.5 | 315.5 | 783.1 | 846.1 | 1,128.8 |

| Higher education | 1,869 | 2,040 | 2,153 | 166.3 | 173.3 | 230.9 | 140.2 | 169.3 | 207.4 | 527.6 | 549.7 | 736.3 |

| Other education | 54,161 | 48,347 | 52,061 | 85.4 | 95.1 | 123.4 | 70.3 | 92.2 | 108.1 | 255.5 | 296.4 | 392.5 |

| Environment and animals | 12,721 | 12,715 | 14,591 | 13.0 | 14.7 | 19.7 | 11.0 | 13.7 | 16.5 | 32.0 | 37.7 | 47.8 |

| Health | 40,774 | 38,840 | 38,861 | 817.2 | 986.0 | 1,160.5 | 775.8 | 944.6 | 1,102.3 | 1,000.8 | 1,238.9 | 1,574.1 |

| Hospitals and primary care facilities | 7,150 | 7,229 | 7,113 | 689.3 | 838.3 | 977.1 | 658.4 | 802.8 | 926.7 | 790.1 | 1,004.2 | 1,281.5 |

| Other health care | 33,624 | 31,611 | 31,748 | 127.9 | 147.7 | 183.4 | 117.4 | 141.8 | 175.6 | 210.7 | 234.7 | 292.6 |

| Human services | 105,938 | 103,451 | 110,801 | 185.3 | 213.3 | 234.1 | 176.8 | 206.2 | 224.0 | 274.3 | 321.2 | 357.1 |

| International | 5,691 | 6,066 | 6,927 | 30.5 | 32.0 | 38.5 | 27.1 | 31.1 | 34.5 | 28.5 | 31.3 | 43.2 |

| Other public and social benefit | 38,381 | 34,595 | 37,478 | 82.3 | 81.2 | 111.3 | 68.2 | 77.0 | 93.3 | 262.5 | 292.6 | 347.1 |

| Religion related | 18,761 | 17,802 | 20,443 | 12.3 | 13.9 | 19.6 | 10.6 | 12.9 | 17.1 | 26.9 | 31.0 | 42.6 |

Sources: Urban Institute, National Center for Charitable Statistics, Core Files (Public Charities, 2005, 2010, and 2015).

Note: Subtotals may not sum to totals because of rounding.

Public charities’ financial growth within the given span largely occurred within the second half (table 4). From 2005 to 2010, revenue and assets for all public charities increased 15.2 and 15.9 percent, respectively, but both grew much more quickly in the years following: 20.6 percent for revenues and 26.3 percent for assets, after adjusting for inflation. Further, expenses grew much faster than revenues between 2005 and 2010, with expenses increasing 20.6 percent (compared with revenues increasing 15.2 percent). But between 2010 and 2015 growth in expenses (16.6 percent) was outpaced by the growth in revenues (20.6 percent).

These periods of growth varied by subsector, however. Two subsectors experienced declining revenue between 2005 and 2010: arts, culture, and humanities organizations and other public and social benefit organizations. Of the two, other public and social benefit organizations experienced the larger decline, falling $1.1 billion in revenue from 2005 to 2010, a decline of 1.3 percent. However, both subsectors experienced substantial revenue increases from 2010 to 2015: revenue for other public and social benefit organizations grew 37.1 percent during those five years, while revenue for arts, culture and humanities organizations grew 28.9 percent. Both revenue growth rates were well above the growth rate for human services organizations, which at 9.8 percent was the lowest for any subsector within that period.

TABLE 4

Percent Change in Revenue, Expenses, and Assets of Reporting Public Charities by Subsector, 2005–2015 (adjusted for inflation)

- #Display Table 4 Data

- kable(Table4_2015[c(2:11)], format.args = list(decimal.mark = ‘.’, big.mark = “,”),

- “html”,

- col.names = c(“”, paste(“2005”, “u2013”, “15”, sep = “”), paste(“2005”, “u2013”, “10”, sep = “”), paste(“2010”, “u2013”, “15”, sep = “”), paste(“2005”, “u2013”, “15”, sep = “”), paste(“2005”, “u2013”, “10”, sep = “”), paste(“2010”, “u2013”, “15”, sep = “”), paste(“2005”, “u2013”, “15”, sep = “”), paste(“2005”, “u2013”, “10”, sep = “”), paste(“2010”, “u2013”, “15”, sep = “”)),

- align = “lccccccccc”) %>%

- kable_styling(“hover”, full_width = F) %>%

- row_spec(c(4,5,8,9), italic = T ) %>%

- row_spec(1, bold = T ) %>%

- add_indent(c(4,5,8,9)) %>%

- add_header_above(c(” “, “Change in Revenues” = 3, “Change in Expenses” = 3,”Change in Assets” = 3))

| Change in Revenues | Change in Expenses | Change in Assets | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 2005–15 | 2005–10 | 2010–15 | 2005–15 | 2005–10 | 2010–15 | 2005–15 | 2005–10 | 2010–15 | |

| All public charities | 38.9 | 15.2 | 20.6 | 40.6 | 20.6 | 16.6 | 46.4 | 15.9 | 26.3 |

| Arts | 28.1 | -0.6 | 28.9 | 28.9 | 7.9 | 19.4 | 30.1 | 7.1 | 21.5 |

| Education | 40.8 | 6.6 | 32.0 | 49.9 | 24.2 | 20.7 | 44.1 | 8.0 | 33.4 |

| Higher education | 38.8 | 4.2 | 33.2 | 47.9 | 20.8 | 22.5 | 39.6 | 4.2 | 33.9 |

| Other education | 44.5 | 11.4 | 29.8 | 53.8 | 31.2 | 17.2 | 53.6 | 16.0 | 32.4 |

| Environment and animals | 51.5 | 13.1 | 34.0 | 50.0 | 24.5 | 20.4 | 49.4 | 17.8 | 26.8 |

| Health | 42.0 | 20.7 | 17.7 | 42.1 | 21.8 | 16.7 | 57.3 | 23.8 | 27.1 |

| Hospitals and primary care facilities | 41.8 | 21.6 | 16.6 | 40.8 | 21.9 | 15.4 | 62.2 | 27.1 | 27.6 |

| Other health care | 43.4 | 15.5 | 24.2 | 49.6 | 20.8 | 23.8 | 38.9 | 11.4 | 24.7 |

| Human services | 26.3 | 15.1 | 9.8 | 26.7 | 16.6 | 8.6 | 30.2 | 17.1 | 11.2 |

| International | 26.2 | 4.9 | 20.3 | 27.3 | 14.8 | 10.9 | 51.6 | 9.8 | 38.0 |

| Other public and social benefit | 35.2 | -1.3 | 37.1 | 36.8 | 12.9 | 21.2 | 32.2 | 11.5 | 18.6 |

| Religion related | 59.3 | 13.0 | 41.0 | 61.3 | 21.7 | 32.6 | 58.4 | 15.2 | 37.4 |

Sources: Urban Institute, National Center for Charitable Statistics, Core Files (Public Charities, 2005, 2010, and 2015).

Note: Subtotals may not sum to totals because of rounding.

Back to topGiving

Giving Amounts

- #Create Figure 2 underlying table

- #Import Figure 2 raw data (available from Giving USA 2018, https://givingusa.org/)

- Figure2 <- read_csv("External_Data/GivingUSACont.csv",

- col_types = cols_only(Years = col_integer(),

- Current_Dollars = col_double()

- ))

- #Adjust for inflation

- Figure2 %

- mutate(

- ‘Constant (2017) Dollars’ = round((Current_Dollars * inflindex[as.character(2017),])/(inflindex[as.character(Years),]), digits =2)

- )

- #Add Column Names

- colnames(Figure2)<- c("Year", "Current dollars", "Constant (2017) dollars")

- Figure2 %

- melt(id = “Year”)

- colnames(Figure2)[2] <- "Contributions"

- #Write final table to CSV

- write.csv(Figure2, “Figures/NSiB_Figure2_Table.csv”)

Private charitable contributions reached an estimated $410.02 billion in 2017, as shown in figure 2 below (Giving USA Foundation 2018). Total charitable giving has been increasing for four consecutive years, beginning with 2014. Since 2007, private giving has increased 11.5 percent, adjusting for inflation.

FIGURE 2

Private Charitable Contributions 2000-2017

- #Create Figure 2

- Fig2Plot <- function(Fig2Table) {

- Fig2 %

- ggplot(aes(x=Year, y =value, fill = Contributions)) +

- geom_bar(position = “dodge”, stat = “identity”) +

- geom_text(aes(label = formatC(round(value,2), format = ‘f’, digits =2)),

- position= position_dodge(width=1),

- hjust =-.1,

- size=3) +

- scale_y_continuous(expand = c(0, 0), limits = c(0,450)) +

- scale_x_continuous(breaks = 2000:2017)+

- theme(axis.text.x = element_blank(),

- axis.ticks.x = element_blank(),

- panel.grid.major = element_blank()#,

- # axis.title.y = element_text(angle=0)

- ) +

- labs(#title = “Figure 2”,

- #subtitle = “Private Charitable Contributions, 2000-2016”,

- #caption = “Giving USA Foundation (2018)”,

- x = “Year”,

- y = “”) +

- coord_flip()

- UrbCaption <- grobTree(

- gp = gpar(fontsize = 8, hjust = 1),

- textGrob(label = “I N S T I T U T E”,

- name = “caption1”,

- x = unit(1, “npc”),

- y = unit(0, “npc”),

- hjust = 1,

- vjust = 0),

- textGrob(label = “U R B A N “,